The launch of the spot Bitcoin ETFs has been more successful than almost any dared to imagine. The positive performance of these products, as measured by both inflows and share price, warrants some consideration.

This article will explore the magnitude and speed of Bitcoin ETF success, the regulatory hurdles these funds faced before approval, and take an in-depth look at how some of the most popular securities are structured.

Bitcoin ETFs: The Most Successful ETF Launch in History

Within a single day of being listed, the Bitcoin ETFs saw over $4 billion in inflows, shattering records held by any ETFs that debuted prior. As the weeks and months went on, many of the individual funds continued to break records.

Over the last 30 years, 5,535 ETFs have launched, with all of them seeing less impressive numbers than the ETFs offered by companies like Blackrock and Fidelity. Within one month of trading, Fidelity’s FBTC had gathered almost $3.5 billion in AUM, while BlackRock’s IBIT had attracted over $4 billion.

By comparison, the first gold ETF accumulated $1.2 billion in its first month. The ETF that held the previous record for fastest inflows was BlackRock’s Climate Conscious Fund, launched in August 2023, having collected $2.2 billion in its first month.

BlackRock’s #Bitcoin ETF holds more than 300,000 $BTC pic.twitter.com/wcm47bvron

— Quinten | 048.eth (@QuintenFrancois) June 10, 2024

Challenges Prior to Approval

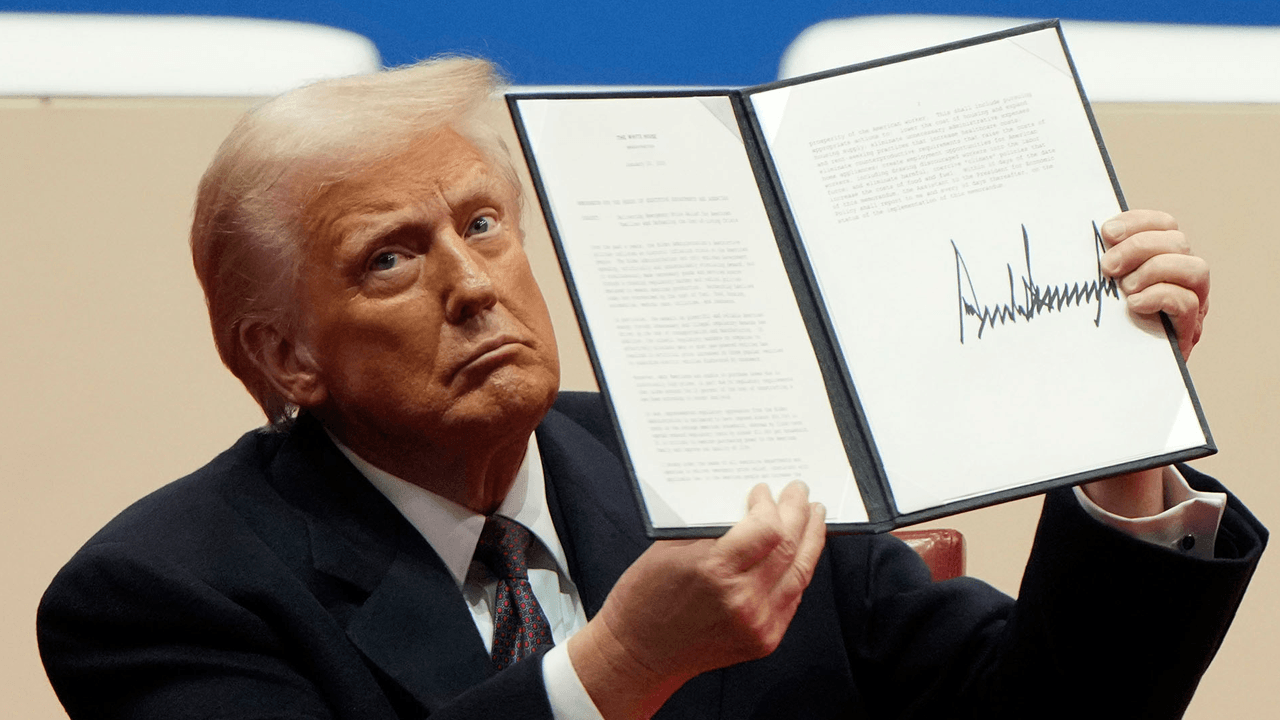

While first approval didn’t happen until January 10, 2024, the Bitcoin ETFs had been in the works for over a decade.

In July 2013, Cameron and Tyler Winklevoss, founders of the crypto exchange known as Gemini, filed the first application for a spot Bitcoin ETF. This was the same year that Grayscale Investments launched its Bitcoin Investment Trust, which would later be listed as a public security under the ticker “GBTC” in 2020. GBTC was the first publicly traded Bitcoin fund available in the US.

Between the years of 2013 and 2018, the Winklevoss twins were rejected multiple times by the Securities and Exchange Commission (SEC) for various ETF applications. Each time, the SEC claimed there were not sufficient regulatory controls in place for the crypto markets to safely launch such a product.

In 2021, the first Canadian spot Bitcoin ETF was launched. This was also the same year that current SEC chair Gary Gensler took his position.

In October 2021, the first Bitcoin futures ETF was launched. ProShares Bitcoin Trust was listed on the Chicago Mercantile Exchange (CME), with SEC approval being based on the idea that the CME has adequate market surveillance measures in place to prevent manipulation. Grayscale also submitted a second application to the SEC to convert GBTC into a spot ETF at this time.

In 2022, the SEC rejected multiple applications for spot Bitcoin ETFs, including Grayscale’s, which resulted in Grayscale Investments filing a lawsuit against the regulatory agency.

In 2023, BlackRock and ARK Investments both filed spot Bitcoin ETF applications with the SEC. Many other hopeful issuers like Invesco and Fidelity followed suit. This prompted speculation that an ETF would finally be approved, given Blackrock’s almost flawless record of receiving such approvals in the past.

Finally, on January 10, 2024, the SEC approved 11 applications for spot Bitcoin ETFs.

How, in 7 Weeks, Bitcoin ETFs Reached Inflows That Took Gold ETFs 3 Years

In this episode, @EricBalchunas, senior ETF Analyst at @Bloomberg Intelligence, discussed the performance of #Bitcoin ETFs since their launch two months ago.

Balchunas noted that the ETFs’ performance… pic.twitter.com/EUmvlQ4vol

— Laura Shin (@laurashin) March 8, 2024

The Making of a Novel ETP: How Spot Bitcoin ETFs Really Work

Because Bitcoin is a new asset class, it can be argued that Bitcoin ETFs constitute a new type of exchange-traded product. While the average ETF provides exposure to a basket of securities, these ETFs are backed by spot Bitcoin, a commodity. For this reason, the closest analogy we have in finance would be gold ETFs. A gold ETF also provides a security that investors can buy to gain access to a single desirable commodity in their portfolios.

Owning gold comes with some complications. Storing or moving it can be risky or expensive. Holding an ETF in a brokerage account can be preferable for some investors. Similarly, buying and holding Bitcoin can be cumbersome for less technical investors, leading them to opt for shares of an ETF instead.

Spot ETFs enable the creation or redemption of fund shares in response to changing market conditions. This provides exposure to the price of Bitcoin without holding the asset. ETF issuers purchase Bitcoin that is then held in a secure wallet by a trusted custodian. Most, if not all, of the funds are held in what’s known as cold storage, meaning they are stored offline where hackers cannot access them. After that, the ETFs issue shares that correspond to those coins. The shares are priced in a way that reflects the current spot price of Bitcoin.

At times, a spot ETF’s price may differ from the underlying asset’s current value. When this happens, the fund must re-balance its outstanding shares against the assets it holds. To achieve this, large blocks of shares can be created or redeemed by authorized participants, or APs, in order to align the share price of the fund with the value of the underlying asset. APs are usually big banks that take advantage of the arbitrage opportunity presented by the price of an ETF being greater or lower than the value of the underlying asset.

YTD performance 👇 Commodity ETFs & Bitcoin ETFs$GLD $SLV $IAU $USO $UNG $SGOL $PPLT $DBC $DBA $BITB pic.twitter.com/0ydsJSDHGA

— HODL15Capital 🇺🇸 (@HODL15Capital) June 9, 2024

What the Future Might Hold

While the future is always difficult to forecast, the trends for spot Bitcoin ETFs seem to be on an upward trajectory. Ric Edelman, founder of the Digital Assets Council of Financial Professionals, recently told CNBC that he believes $150 billion could flow into the ETFs over the next few years. Others have speculated that sovereign wealth funds or central banks could begin buying or mining Bitcoin, which would result in a significant increase in demand.

The success of spot Bitcoin ETFs marks a historic achievement in financial markets. Despite facing regulatory hurdles, these ETFs have shattered records for inflows and performance, with funds like Fidelity’s FBTC and BlackRock’s IBIT leading the way.

The journey from initial rejection to approval highlights the evolution of crypto market oversight. The ETF structure ensures alignment between share prices and underlying asset values. As a result, spot Bitcoin ETFs have emerged as an intriguing new investment vehicle, demonstrating the mainstream acceptance of Bitcoin.

The launch of the spot Bitcoin ETFs has been more successful than almost any dared to imagine. The positive performance of these products, as measured by both inflows and share price, warrants some consideration.

This article will explore the magnitude and speed of Bitcoin ETF success, the regulatory hurdles these funds faced before approval, and take an in-depth look at how some of the most popular securities are structured.

Bitcoin ETFs: The Most Successful ETF Launch in History

Within a single day of being listed, the Bitcoin ETFs saw over $4 billion in inflows, shattering records held by any ETFs that debuted prior. As the weeks and months went on, many of the individual funds continued to break records.

Over the last 30 years, 5,535 ETFs have launched, with all of them seeing less impressive numbers than the ETFs offered by companies like Blackrock and Fidelity. Within one month of trading, Fidelity’s FBTC had gathered almost $3.5 billion in AUM, while BlackRock’s IBIT had attracted over $4 billion.

By comparison, the first gold ETF accumulated $1.2 billion in its first month. The ETF that held the previous record for fastest inflows was BlackRock’s Climate Conscious Fund, launched in August 2023, having collected $2.2 billion in its first month.

BlackRock’s #Bitcoin ETF holds more than 300,000 $BTC pic.twitter.com/wcm47bvron

— Quinten | 048.eth (@QuintenFrancois) June 10, 2024

Challenges Prior to Approval

While first approval didn’t happen until January 10, 2024, the Bitcoin ETFs had been in the works for over a decade.

In July 2013, Cameron and Tyler Winklevoss, founders of the crypto exchange known as Gemini, filed the first application for a spot Bitcoin ETF. This was the same year that Grayscale Investments launched its Bitcoin Investment Trust, which would later be listed as a public security under the ticker “GBTC” in 2020. GBTC was the first publicly traded Bitcoin fund available in the US.

Between the years of 2013 and 2018, the Winklevoss twins were rejected multiple times by the Securities and Exchange Commission (SEC) for various ETF applications. Each time, the SEC claimed there were not sufficient regulatory controls in place for the crypto markets to safely launch such a product.

In 2021, the first Canadian spot Bitcoin ETF was launched. This was also the same year that current SEC chair Gary Gensler took his position.

In October 2021, the first Bitcoin futures ETF was launched. ProShares Bitcoin Trust was listed on the Chicago Mercantile Exchange (CME), with SEC approval being based on the idea that the CME has adequate market surveillance measures in place to prevent manipulation. Grayscale also submitted a second application to the SEC to convert GBTC into a spot ETF at this time.

In 2022, the SEC rejected multiple applications for spot Bitcoin ETFs, including Grayscale’s, which resulted in Grayscale Investments filing a lawsuit against the regulatory agency.

In 2023, BlackRock and ARK Investments both filed spot Bitcoin ETF applications with the SEC. Many other hopeful issuers like Invesco and Fidelity followed suit. This prompted speculation that an ETF would finally be approved, given Blackrock’s almost flawless record of receiving such approvals in the past.

Finally, on January 10, 2024, the SEC approved 11 applications for spot Bitcoin ETFs.

How, in 7 Weeks, Bitcoin ETFs Reached Inflows That Took Gold ETFs 3 Years

In this episode, @EricBalchunas, senior ETF Analyst at @Bloomberg Intelligence, discussed the performance of #Bitcoin ETFs since their launch two months ago.

Balchunas noted that the ETFs’ performance… pic.twitter.com/EUmvlQ4vol

— Laura Shin (@laurashin) March 8, 2024

The Making of a Novel ETP: How Spot Bitcoin ETFs Really Work

Because Bitcoin is a new asset class, it can be argued that Bitcoin ETFs constitute a new type of exchange-traded product. While the average ETF provides exposure to a basket of securities, these ETFs are backed by spot Bitcoin, a commodity. For this reason, the closest analogy we have in finance would be gold ETFs. A gold ETF also provides a security that investors can buy to gain access to a single desirable commodity in their portfolios.

Owning gold comes with some complications. Storing or moving it can be risky or expensive. Holding an ETF in a brokerage account can be preferable for some investors. Similarly, buying and holding Bitcoin can be cumbersome for less technical investors, leading them to opt for shares of an ETF instead.

Spot ETFs enable the creation or redemption of fund shares in response to changing market conditions. This provides exposure to the price of Bitcoin without holding the asset. ETF issuers purchase Bitcoin that is then held in a secure wallet by a trusted custodian. Most, if not all, of the funds are held in what’s known as cold storage, meaning they are stored offline where hackers cannot access them. After that, the ETFs issue shares that correspond to those coins. The shares are priced in a way that reflects the current spot price of Bitcoin.

At times, a spot ETF’s price may differ from the underlying asset’s current value. When this happens, the fund must re-balance its outstanding shares against the assets it holds. To achieve this, large blocks of shares can be created or redeemed by authorized participants, or APs, in order to align the share price of the fund with the value of the underlying asset. APs are usually big banks that take advantage of the arbitrage opportunity presented by the price of an ETF being greater or lower than the value of the underlying asset.

YTD performance 👇 Commodity ETFs & Bitcoin ETFs$GLD $SLV $IAU $USO $UNG $SGOL $PPLT $DBC $DBA $BITB pic.twitter.com/0ydsJSDHGA

— HODL15Capital 🇺🇸 (@HODL15Capital) June 9, 2024

What the Future Might Hold

While the future is always difficult to forecast, the trends for spot Bitcoin ETFs seem to be on an upward trajectory. Ric Edelman, founder of the Digital Assets Council of Financial Professionals, recently told CNBC that he believes $150 billion could flow into the ETFs over the next few years. Others have speculated that sovereign wealth funds or central banks could begin buying or mining Bitcoin, which would result in a significant increase in demand.

The success of spot Bitcoin ETFs marks a historic achievement in financial markets. Despite facing regulatory hurdles, these ETFs have shattered records for inflows and performance, with funds like Fidelity’s FBTC and BlackRock’s IBIT leading the way.

The journey from initial rejection to approval highlights the evolution of crypto market oversight. The ETF structure ensures alignment between share prices and underlying asset values. As a result, spot Bitcoin ETFs have emerged as an intriguing new investment vehicle, demonstrating the mainstream acceptance of Bitcoin.