This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

Image source

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

You have to buy a lot of newspapers for the verification process. Not very practical.Each contract needs its own space in the newspaper. Not very scalable.The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

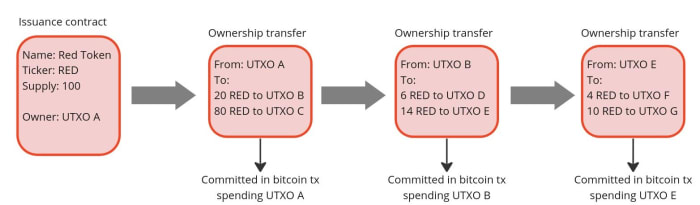

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

![[LIVE] Latest Crypto News, August 19 – Bitcoin Price Struggles To Hold $115K, XRP Reclaims $3: Best Altcoins To Buy Right Now? [LIVE] Latest Crypto News, August 19 – Bitcoin Price Struggles To Hold $115K, XRP Reclaims $3: Best Altcoins To Buy Right Now?](https://99bitcoins.com/wp-content/uploads/2025/04/Fatima99btc.jpg)