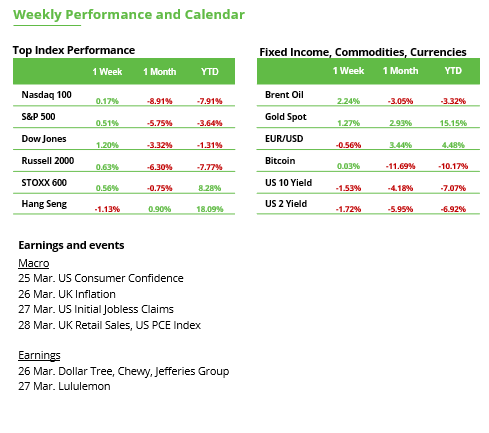

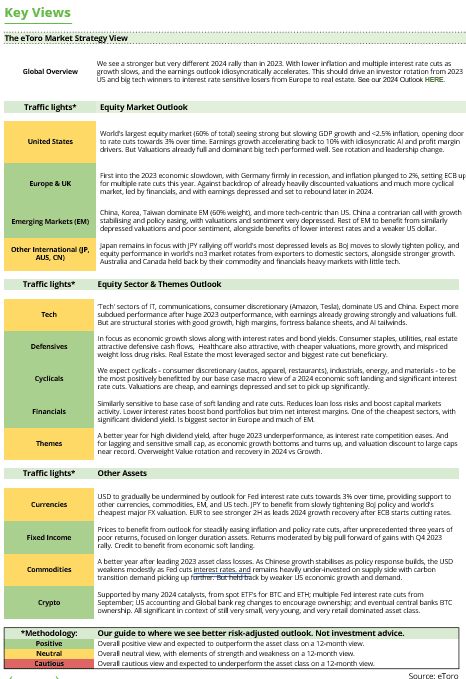

At its March meeting, the Fed kept rates steady at 4.25-4.50%. Don’t pop the champagne yet, though. The Fed also signalled it’s not declaring victory on inflation: officials nudged their inflation forecasts higher and trimmed growth expectations, citing a “highly uncertain” outlook. Translation? The outlook’s still foggy, and those inflation-fuelling tariffs aren’t helping.

What It Means For Your Money:

Higher-for-longer rates remind us to be selective in stocks – focus on companies that can thrive in a moderate-growth, moderate-inflation world.

Banks benefit from higher net interest margins (they earn more on loans vs. what they pay on deposits), and insurers can earn more from investing premiums.

Consumer staples tend to have reliable cash flow and can pass some inflation on to consumers.

Healthcare demand is non-cyclical — people need meds and procedures regardless of rates. Many healthcare companies have stable cash flows and pricing power.

Not all tech gets punished in a high-rate world. Cash-generating businesses with strong moats and cost control can still outperform. Cloud, cybersecurity, and AI-infrastructure players remain long-term winners.

To avoid: 1. High-growth, no-profit tech that get hit hardest by higher discount rates. 2. Real estate (especially commercial REITs) + higher rates = more expensive debt, lower property values. 3. Highly leveraged sectors – businesses loaded with debt see profits eaten up by higher interest costs.

Earnings Season: Big Names, Small Surprises

Nike, FedEx, and Accenture all disappointed—and Wall Street noticed.

Nike expects further revenue declines, still untangling last year’s inventory overload and seeing weaker demand. Trump’s tariffs on China and Mexico could contribute to a sharp decline in profitability. Nike imports 18% of its Nike-branded footwear from China, which Trump has levied an additional 20% tariffs on.

FedEx is navigating higher costs and a dip in global shipping volumes as businesses cool their spending.

Accenture? Down 13% year-to-date after corporate clients hit the cancel button on big contracts (coupled with DOGE-related cancellations)– a possible sign that the corporate spending frenzy of the last few years is easing up.

What’s going on? If people aren’t snapping up sneakers like they used to, or shippers like FedEx are seeing fewer packages, it points to a broader economic cooldown on the horizon. But here’s the silver lining: a mild slowdown might be exactly what the Fed (and long-term investors worried about overheating) need to cool inflation without a hard landing. And context is key: all three companies have weathered slowdowns before. Each is still a dominant player in its field, with solid long-run prospects. The cautious signals from Nike, FedEx, and Accenture remind us to keep an eye on the broader economy’s pulse.

Bottomline: For long-term investors, dips in proven names caused by temporary headwinds can even be opportunities. If you’ve done your homework and believe in a company’s long-term story, a 5% drop on an earnings miss might be a chance to buy at a discount. Just make sure those short-term issues (weak consumer demand, higher costs, etc.) don’t threaten the company’s long-term competitive edge.

PMI Data in Focus: Can Leading Indicators Rebuild Investor Confidence?

Investors Seeking Direction: Market participants are facing many questions in the current environment – and rightly so. Trump remains the biggest uncertainty factor, casting a thick fog over the markets. Many investors feel in the dark, searching for clarity and orientation. Volatility has increased significantly in recent weeks, particularly in the U.S.. According to the RSI, the S&P 500 futures were as oversold on the daily chart as they were last seen in September 2022, following the recent sell-off. Even the recently strong European stock market hasn’t been immune. While the swings have been less pronounced, the STOXX Europe 600 recently experienced a 5% dip – a clear sign that global uncertainty is spreading.

Shifting Market Conditions: While some investors see recent price weaknesses as buying opportunities, others believe the correction is far from over. The Fed’s message last week captured the dilemma investors currently face: uncertainty makes forecasting extremely difficult. That doesn’t mean the market is collapsing—but the environment has clearly changed. Volatility is back, and it’s likely here to stay. Rather than panicking, investors should adapt and get used to the new conditions. After all, Trump will remain a major market factor for nearly four more years.

PMI Data as a Reality Check: Leading indicators aren’t the holy grail, but they offer a useful glimpse into what’s ahead. On Monday, the March PMI data for Europe and the U.S. will be released and could serve as a timely reality check for investors. In the U.S., the picture has shifted in recent months (see chart below). The manufacturing sector (52.7) has managed to recover from its downturn, while the services sector (51.0) continues to show signs of weakness. A similar trend can be seen in Europe, though with a key difference: manufacturing remains in recession territory (47.6), while the services PMI is hovering closer to the neutral 50 mark (50.6). Investors should watch closely for new momentum or significant deviations from expectations. The main focus remains on inflation risks, particularly those linked to rising tariffs.

Federal Council Approves Germany’s Financial Package: The planned €1 trillion in new debt will be financed through various channels. Infrastructure and climate investments will be funded via a special fund, while defense, security, and support for Ukraine will be covered by a relaxed debt brake. The muted market reaction in the DAX, euro, and German government bonds suggests that the increased public spending was largely priced in. One thing is clear: interest costs will rise and put long-term pressure on the federal budget. A strong economic recovery will be essential to keep the debt manageable—for now, markets remain hopeful that Germany’s economy will rebound significantly in the coming years.

Bottomline: Investors should take the Trump factor seriously, but not panic. The key is to stay calm and think long-term. Rising volatility also presents new opportunities—those who remain flexible can benefit. Attention should also be paid to the differing dynamics between the U.S. and Europe. The upcoming PMI data will be an important indicator. Germany’s financial package may provide a short-term boost, but what really matters is whether the investments are targeted and effectively implemented to support sustainable growth.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.