After FTX collapsed, scornful critics widely ridiculed Caroline Ellison’s approach to stop losses. ‘I just don’t don’t think they’re an effective risk management tool,’ she infamously told an audience during FTX’s heyday. But did she have a point?

Venturing into the crypto asset management realm presents a unique set of challenges that differ widely from the traditional fund space. In this primer piece, we will delve into the obstacles that aspiring fund managers face when launching a bitcoin sector fund and examine the key differences that exist when you step outside the world of traditional asset management.

Volatility and Risk Management

One of the most significant challenges faced by bitcoin sector funds is the extreme volatility that exists within the cryptocurrency market. Bitcoin’s price has witnessed strong bullish surges, driving excitement among investors. However, it has also experienced strong bearish declines, leading to substantial losses for those unprepared for such price swings. Managing risk in such a dynamic environment requires sophisticated strategies, rigorous risk frameworks and assessments, and a deep understanding of market trends.

Unlike most traditional and mainstream blue chip assets, which often experience relatively stable price movements, bitcoin’s price can change meaningfully within a matter of hours. Consequently, bitcoin sector fund managers must be well-equipped to handle sudden price fluctuations to protect their investors’ capital. Traditional stop loss structures may not work to the extent expected, as the closing market order may get executed far below the preset trigger price due to orderbook slippage and rapid price movements, the proverbial “catching of a falling knife”. Using tight stop losses as a foundational risk management mechanism can be your enemy. For example, in a flash crash scenario, positions may be automatically sold at a loss even though the market reverted a few minutes (or seconds) later.

While stop losses are an alternative, they’re not an option! Options are contracts you can buy that give you the right to buy or sell a given asset at a predetermined price (i.e., the strike price) at a given time (i.e., the expiration date). An option to buy an asset is a call and an option to sell one is a put. Buying an out-of-the-money put (i.e., far below the current price) can act as a floor on your potential losses if the price collapses. Think of it as a premium paid to insure your position.

Sometimes to defend against binary result events or particularly high volatility timeframes you just have to flatten your positions and take no risk, living to fight another day in the bitcoin market. Think for example of key protocol update dates, regulatory decisions or the next Bitcoin halving; though note the market moves ahead of those events so you may have to take action beforehand.

Creating an effective risk management plan for a bitcoin sector fund may involve using various hedging techniques, product and instrument diversification (potentially across asset classes), trading venue risk scoring and risk-adjusted allocations, dynamic trade sizing, dynamic leverage settings, and employing robust analytical tools to monitor market sentiment and potential market and operational risks.

Custody and Security

The custody of Bitcoin and other cryptocurrencies is a critical aspect that distinguishes bitcoin sector funds from their traditional counterparts. One key difference is that unlike traditional exchanges that only match orders, bitcoin exchanges do the order matching, margining, settlement, and custody of the assets. The exchange itself becomes the clearinghouse, concentrating counterparty risk as opposed to alleviating it. Decentralized exchanges come with a unique set of risks as well, from fending off miner-extracted value to being ready to move assets in case of a protocol or bridge hack.

For these reasons, safeguarding digital assets from theft or hacking requires robust security measures, including but not limited to multi-signature protocols, cold storage solutions, and risk monitoring tools. The responsibility of securely managing private keys and choosing and monitoring reliable trading venues rests entirely with the fund manager. The burden to monitor the market infrastructure itself introduces a level of technical complexity absent in traditional fund management where custody and settlement are standardized and commoditized standalone systems.

Custodial solutions for bitcoin sector funds must be carefully selected, ensuring that assets are protected against cyberattacks and insider threats. With the history of high-profile cryptocurrency exchange hacks, investors are particularly concerned about the safety of their assets; any breach in security could lead to significant financial losses and damage the reputation of the fund.

Conclusion

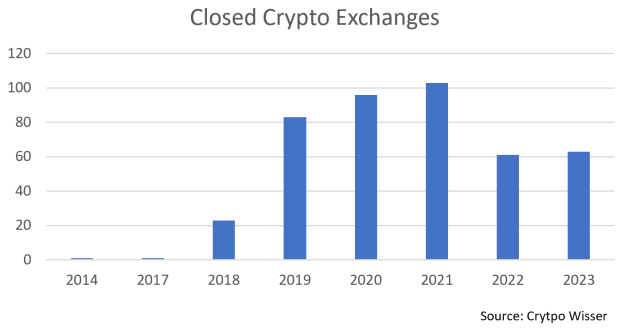

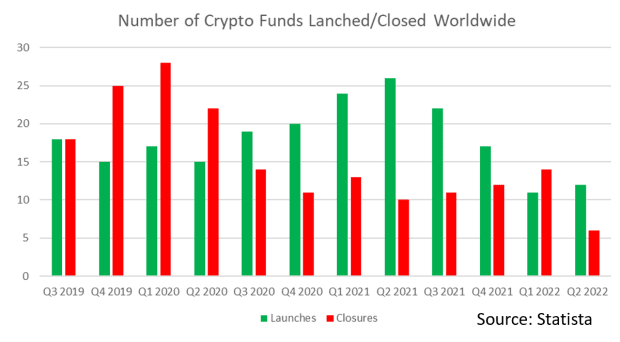

Launching a bitcoin sector fund is a thrilling endeavor that offers unprecedented opportunities for investors seeking exposure to the fast-growing cryptocurrency market. It is important, however, to understand that launching a fund is no easy feat with pitfalls going beyond the success of the trading strategy. It is no surprise that every quarter the fund closures are in the same range of fund launches.

Those entering the bitcoin sector fund space should approach it with a pioneering spirit, stay informed, and embrace the dynamic nature of this exciting emerging market. While the road may be challenging, the potential rewards for successful bitcoin sector fund managers could be astronomical.

If you’re ready to start the fund building journey, already en route, or would just like to learn more, reach out to us at advisory@satoshi.capital.

This is a guest post by Daniel Truque. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

![[LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode? [LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode?](https://99bitcoins.com/wp-content/uploads/2025/08/IMG_0834-scaled.png)