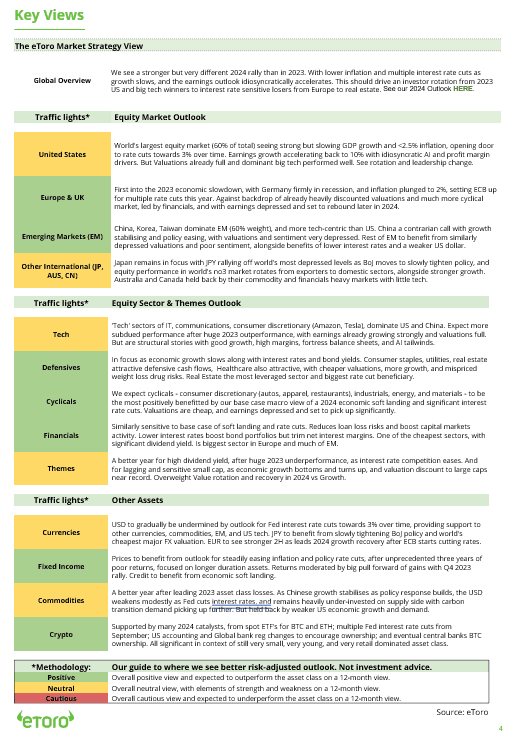

Markets have been on a rollercoaster since the US declared its tariff “Liberation Day” on April 2. Investors have been scrambling to adjust portfolios, seeking shelter from the trade-war storm while sniffing out any silver linings.

Defensive is the New Offense

After the tariff bombshell, a clear trend emerged: rotation into defensive sectors and away from trade-sensitive cyclicals. In Europe, traditionally “boring” plays like utilities, real estate, and defence stocks suddenly became stars as tariff jitters set in. Conversely, sectors tied to global trade took a hit – luxury goods, banks, and industrials slumped, and tech shares wobbled. The message: if a company’s profits depend on globalization, investors are tapping the brakes.

Not everyone is fleeing growth entirely, but there’s a newfound picky approach. Some favour services over goods in consumer plays and cash-rich large caps over fragile small caps. In other words, quality and resilience are the name of the game. And gold is gleaming again – both as a diversifier and recession hedge.

Rethinking the Map The tariff shock has upended regional preferences too. US equities, once stalwart, suddenly look shakier on growth fears. Many investors think that “Liberation Day will probably not represent the short-term bottom for US equities.

The UK, hit with a milder 10% tariff, has shown resilience; London’s FTSE fell less than continental indexes. Some even think Britain might snag a competitive edge – goods made in the UK face lower US tariffs than EU-made ones, potentially encouraging a bit of reshoring to British shores.

Europe, despite facing a hefty 20% US tariff, isn’t being abandoned – the EU has both the clout and policy tools to buffer the impact. Meanwhile, emerging Asia has been largely put in the penalty box. With key Asian economies facing 30%+ tariffs, many managers are trimming exposure to Asian and other EM equities. For UK and European investors, staying closer to home feels safer for now.

Sentiment, Commodities & Currencies

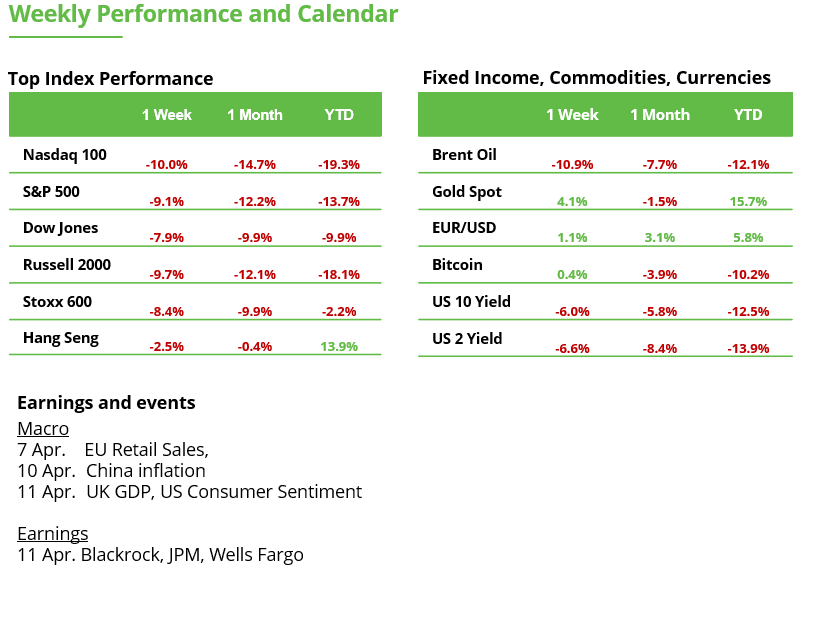

In the immediate aftermath, risk-off sentiment spiked. Global stocks plunged – US indices fell around 5% in a day – and investors dashed for cover in safe havens like bonds, gold, and the Japanese yen. Government bond yields slid as prices jumped, and oil prices slumped on fears of a trade-induced slowdown. Notably, the US dollar fell instead of strengthening, as markets wagered the Fed will have to counteract the growth hit. The euro and even the pound firmed against the greenback amid the turmoil.

Bottom line: investors in Europe and the UK are hunkering down, leaning into defense and trimming exposure to the eye of the storm. There’s cautious hope a negotiated truce will emerge – but no one’s betting on it yet. For now, portfolios are stocking up on quality names plus extra cash, bonds and gold for safety. It’s the classic “hope for the best, hedge for the worst” playbook as the dust settles from Liberation Day.

Can US quarterly figures reassure despite tariffs and loss of confidence?

Donald Trump’s new tariffs are currently overshadowing everything else in the markets. Recession fears are growing, and investor sentiment is at a low point. Nevertheless, new potential catalysts are on the horizon: U.S. inflation data and the start of earnings season.

Bank earnings as a market barometer: On Friday, U.S. banks will kick off the earnings season. J.P. Morgan and Wells Fargo will be the first to report, offering an initial glimpse into the broader economic picture and how the first quarter has unfolded. The market is eager for positive signals.

Sharply lowered expectations: Financial companies in the S&P 500 are expected to post earnings growth of just 2.6% year-over-year (see chart). Forecasts have been significantly revised downward in recent months. Current estimates stand at less than 40% of what was expected at the end of December. The financial sector is not alone – earnings expectations have been cut across all eleven S&P 500 sectors. A 2.6% increase would also be below average; for the S&P 500 overall, earnings growth of 7.3% is forecast.

Early warning signs for the economy: Recent U.S. survey data is sending clear warning signals. Consumer expectations for the future have dropped to a twelve-year low. Bank earnings now provide key insights into lending activity, credit risk provisioning, and net interest margins. Investors should closely monitor whether there are signs of a weakening real economy and how pronounced they already are.

Overreaction or justified concern? On Friday, panic spread across the banking sector. Losses from the all-time high extended to 16%, and the index fell to its lowest level since September. On the daily chart, the RSI indicator dropped below the 30 level – typically a sign of an oversold market.

Trump’s calculus: Donald Trump’s trade policy is not only aimed at foreign partners, but is also strategically motivated domestically. While high tariffs punish U.S. trading partners, Trump appears to have a strong interest in pushing bond yields lower. Lower yields reduce refinancing costs for existing U.S. government debt, potentially saving billions, creating fiscal room that could later be used for tax cuts. A weaker economy or even a recession is being knowingly accepted. Markets have already started pricing in this scenario. On Friday, the yield on the 10-year U.S. Treasury briefly fell below the 4% mark. In January, it was still as high as 4.8%.

Bottomline: This week will reveal whether corporate earnings and inflation data can help restore investor confidence. Historically, markets fall quickly and sharply, while recoveries tend to be slower and often less dynamic – patience is essential. At the same time, the pricing in of tariff-related risks is creating new trading setups and fresh market opportunities.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.