The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Speculation And Yields

This cycle has been super charged by speculation and yield, leading all the way back to the initial Grayscale Bitcoin Trust premium arbitrage opportunity. That opportunity in the market incentivized hedge funds and trading shops from all over the world to lever up in order to capture the premium spread. It was a ripe time for making money, especially back in early 2021 before the trade collapsed and switched to the significant discount we see today.

The same story existed in the perpetual futures market where we saw 7-day average annualized funding rates reach up to 120% at peak. This is the implied annual yield that long positions were paying in the market to short positions. There were an abundance of opportunities in the GBTC and futures markets alone for yield and quick returns to be had — without even mentioning the bucket of DeFi, staking tokens, failed projects and Ponzi schemes that were generating even higher yield opportunities in 2020 and 2021.

There’s an ongoing, vicious feedback loop where higher prices drive more speculation and leverage, which, in turn, drive higher yields. Now, we’re dealing with this cycle in reverse. Lower prices wipe out more speculation and leverage while washing out any “yield” opportunities. As a result, yields everywhere have collapsed.

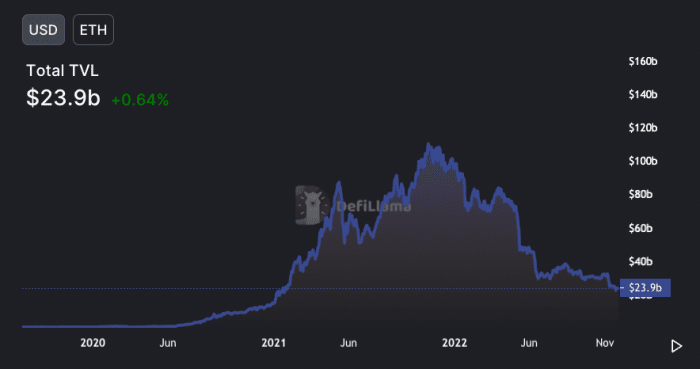

“Total value locked” in the Ethereum DeFi ecosystem surpassed over $100 billion in 2021 during the speculative mania, and is now a mere $23.9 billion today. This leverage-fueled mania in the crypto ecosystem fueled the growth of the “yield” products offered by the market, most of which have all collapsed now that the figurative tide has drawn out.

The total value locked in Ethereum DeFi ecosystem has mostly disappeared

This dynamic brought about the rise of bitcoin and cryptocurrency yield-generating products, from Celsius to BlockFi to FTX and many more. Funds and traders capture a juicy spread while kicking back some of those profits to the retail users who keep their coins on exchanges to get a small amount of interest and yield. Retail users know little about where the yield comes from or the risks involved. Now, all of those short-term opportunities in the market seem to have evaporated.

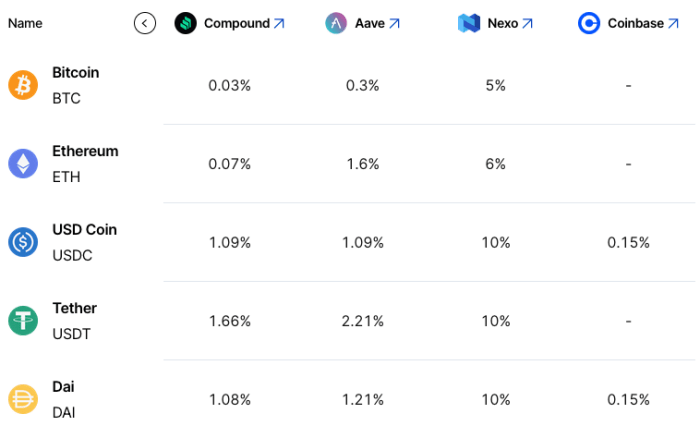

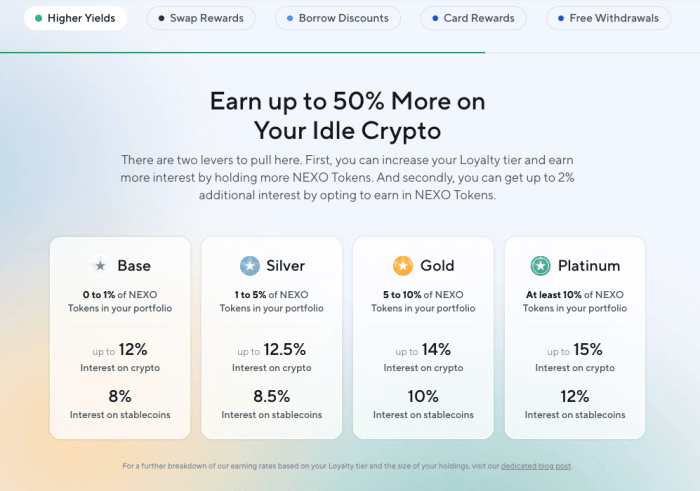

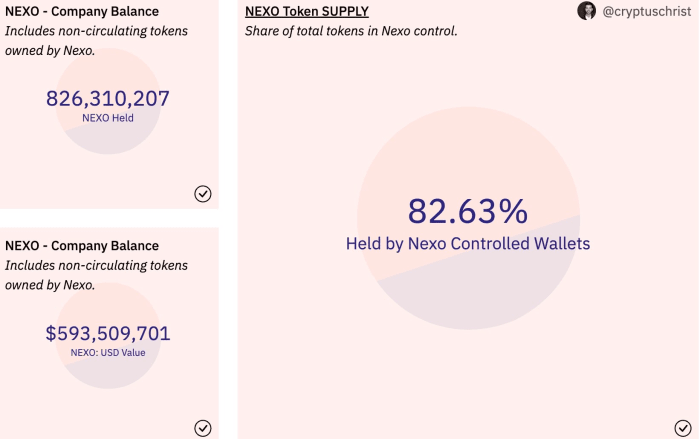

With all of the speculative trades and yield gone, how can companies still offer such high-yielding rates that are well above traditional “risk-free” rates in the market? Where does the yield come from? Not to single out or FUD any specific companies, but take Nexo for example. Rates for USDC and USDT are still at 10% versus 1% on other DeFi platforms. The same goes for bitcoin and ethereum rates, 5% and 6% respectively, while other rates are largely nonexistent elsewhere.

These high borrow rates are collateralized with bitcoin and ether offering a 50% LTV (loan-to-value ratio) while a number of other speculative tokens can be used as collateral as well at a much lower LTV. Nexo shared a detailed thread on their business operations and model. As we’ve found out time and time again, we can never know for sure which institutions to trust or not to trust as this industry de-leveraging continues. However, the main questions to ask are:

Will a 13.9% loan demand be a sustainable business model going forward into this bear market? Won’t rates have to come down further? Regardless of Nexo’s risk management practices, are there heightened counterparty risks currently for holding customer balances on numerous exchanges and DeFi protocols?

Rates on different DeFi lending platforms

Current rates on Nexo’s yield-generating offerings

Statistics for Nexo’s company holdings

Here is what we know:

The crypto-native credit impulse — a metric that is not perfectly quantifiable but imperfectly observable via a variety of datasets and market metrics — has plunged from its 2021 euphoric highs and now looks to be extremely negative. This means that any remaining product that is offering you crypto-native “yield” is likely to be under extreme duress, as the arbitrage strategies that fueled the explosion in yield products throughout the bull market cycle have all disappeared.

What remains, and what will emerge from the depths of this bear market will be the assets/projects built on the strongest of foundations. In our view, there is bitcoin, and there is everything else.

Readers should evaluate counterparty risk in all forms, and stay away from any of the remaining yield products that exist in the market.

Relevant Past Articles:

![[LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode? [LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode?](https://99bitcoins.com/wp-content/uploads/2025/08/IMG_0834-scaled.png)