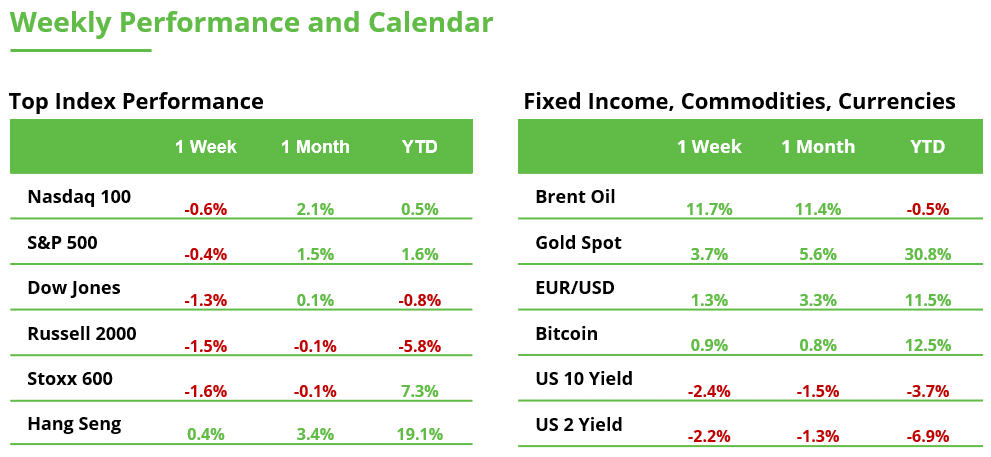

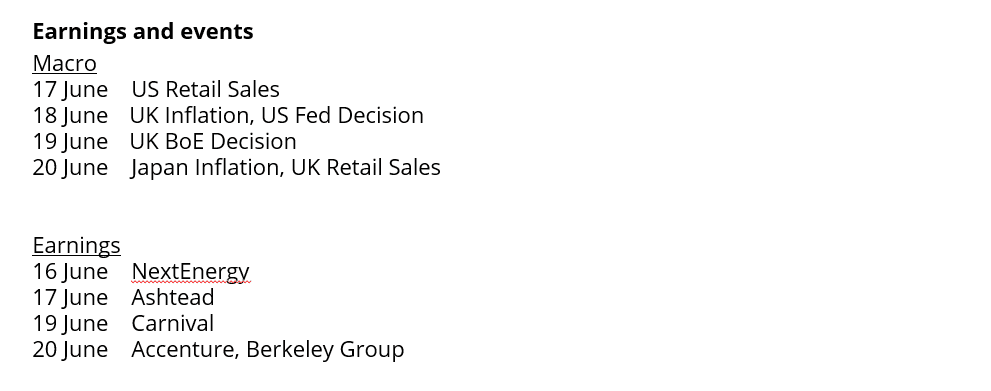

Analyst Weekly, June 16, 2025

Oil Spikes, Risk Premium Builds: What Matters for Investors

Tensions in the Middle East have escalated in recent days, lifting oil prices and reviving geopolitical risk across markets. Brent crude surged more than 13% intraday on June 13, 2025, its biggest single-day move since Russia’s 2022 invasion of Ukraine, before settling 7% higher.

Despite the spike, the oil market wasn’t structurally tight heading into this event. Global demand remained firm, and OPEC+ had been limiting supply, but spare capacity was ample. Iran, for instance, produces around 3 million barrels per day (~4% of global output), and OPEC holds roughly 4 million barrels per day in spare capacity, mostly in Saudi Arabia. That buffer significantly reduces the risk of a sustained oil price shock from isolated disruptions.

The Strait of Hormuz is a critical chokepoint, carrying roughly 30% of global seaborne oil trade. However, a full closure, while often threatened, remains unlikely. Iran’s own exports depend on this passage, and any attempt to block it would risk alienating key buyers like China and destabilizing regional trade. Historically, the strait has never been fully blocked, even in times of heightened conflict.

Historical Context

Oil prices often react sharply to geopolitical events in the Middle East, but history shows that such price moves are typically short-lived. Market behavior in June 2025 mirrors prior episodes, particularly the 1990 Gulf War and the 2022 Ukraine invasion. In all three, oil spiked on broader conflict fears and increased risk premium, as investors rotated into safe havens like gold. By contrast, the 1973 oil embargo triggered a 300% surge in oil prices and a deep recession.

Today, faster information flow, more balanced supply chains, and better-informed investors allow markets to assess risk and reprice more efficiently. In contrast, investors in 1973 and 1990 were caught off-guard by embargoes and invasions, and the macro backdrop – high inflation in the 1970s and recession risk in the early 1990s – amplified the fallout.

In today’s environment of solid growth and tight labor markets, cost shocks like rising oil prices can contribute to inflation persistence. Central banks may respond by delaying rate cuts, but a full policy reversal is unlikely unless oil prices remain elevated for an extended period or inflation expectations become unanchored. For now, policymakers are expected to look through the volatility.

Investment Implications

Be Ready to Act When Markets Overshoot: When geopolitical tensions spark market volatility, fear can often drive prices below fundamentals. One must gauge whether the conflict is a regime-changing event or a temporary shock. Rather than retreating, be prepared to put capital into quality assets that have been unjustly sold off.

History shows that conflict-driven pullbacks can present attractive entry points: during the 2022 Ukraine invasion, many European equities were indiscriminately sold, only to rebound as conditions stabilized. Similarly, after events like the Gulf War and Iraq War, the S&P 500 delivered gains of over 20% within a year. Use these moments of dislocation to your advantage: focus on high-conviction names with strong fundamentals, and buy selectively when panic creates market opportunity.

The prudent course: stay diversified, don’t overreact, and adjust portfolios to absorb short-term volatility without sacrificing long-term objectives.

Diversify and Focus on Quality: Portfolios should lean into high-quality assets, developed market bonds, investment-grade credit, and equities with strong balance sheets and pricing power. These tend to stand volatility better. Within equities, investors may favor companies with reliable cash flows and limited sensitivity to higher input costs.

Select Exposure to Energy and Defense: A modest overweight to energy and defense stocks offers upside if oil prices remain elevated or defense budgets expand. Exposure can be added via sector ETFs ($OilWorldWide), commodity-linked funds, or select equities. Likewise, commodities like oil futures or broad commodity funds can act as hedges: if inflation goes up, these real assets tend to gain value. However, position sizing is important; over-concentration should be avoided, since commodity prices can be volatile and policy actions (like coordinated oil reserve releases) could limit gains.

Maintain Safe-Haven Allocations: Gold remains a favored hedge. Many investors have added to gold positions or used ETFs ($GoldWorldWide) to provide ballast. Government bonds continue to serve as a stabilizer despite limited price appreciation potential.

Hedge Tail Risks: For more advanced strategies, hedging against extreme outcomes may be prudent. Tail risks, such as a prolonged supply disruption (i.e. the closure of the Strait of Hormuz), can have disproportionate market consequences. These scenarios are not basecase, but they require careful monitoring. Instruments like out-of-the-money oil call options or VIX futures can provide asymmetrical protection in the event of a sharp escalation. These hedges may serve as low-cost insurance that can mitigate losses in a worst-case scenario.

Recovery Rally In the US Stock Market Stalls

Geopolitical tensions, skepticism regarding the China deal, and the upcoming Fed rate decision are unsettling investors. The S&P 500 turned lower just before reaching its all-time high and closed last week slightly in the red.

From a technical perspective, the market still offers clear signals. The concept of Fair Value Gaps and the trend structure can help identify potential setups for the new trading week.

Explanation: A Fair Value Gap arises when the market moves very quickly in one direction, leaving no overlap between the high of the previous candle and the low of the next one (violet zones on the chart).

Fair Value Gaps are often considered “magnetic” price areas to which the market might later return. They are therefore frequently used as retracement zones, i.e., potential entry or target areas. However:

Not all Fair Value Gaps are reached (blue zone)

Not all gaps hold (red zone)

Ideally, confirmation is needed, for example through candlestick formations (see positive reactions, green arrows)

Current situation in the S&P 500: The last two Fair Value Gaps in the recent upswing have been defended. This results in three possible scenarios:

Continuation of the new upward move: The market could form a new higher high and confirm the existing upward trend.

Bullish breakout with new gaps: A dynamic upward movement could lead to new fair value gaps over the course of the week.

Break of the most recent Fair Value Gaps: This could signal a trend reversal. Further declines may lead to short setups based on new gaps.

Tips: The simplest approach is to look for long opportunities in an uptrend and short opportunities in a downtrend. Trading against the trend is of course not forbidden, but one should be aware of the associated risks. You surely know the saying “The trend is your friend.”

Additionally, the market is fractal. This means that Fair Value Gaps occur in every time frame and can be used for all investment horizons.

Bottom line: Anyone who thinks they already know on Monday where the market will be by the end of the week should not be too confident. Nothing is 100% predictable. In trading, it’s not about making precise predictions, but about probabilities and risk management. Success depends on good preparation and the development of a repeatable process.

S&P 500, H4 chart (source: eToro)

Key Level for $ETH: It has not closed above this level since January

Ethereum yet again is at its critical level where the bulls and bears will battle it out. Historically this level has acted as a key line-in-the-sand for sentiment. If we can close above, the bulls will be eyeing up the 2025 highs. If we fail to push higher, the bears will be eyeing up the lows of the year again.

Key Trendline for $ISF.L ETF

After a full recovery from the April lows, it is worth keeping an eye on the trend line in the chart for any further potential moves to the upside. A break of this level would be welcome news to the bulls.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.