The Chief Executive Officer of BitMEX, Alexander Höptner, has stepped down from the apex role just short of a couple of years, The Block reported. The existing CFO, Stephan Lutz has already taken over as the Interim CEO of the crypto company.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.

Lutz, who joined the crypto exchange in March 2021, will continue to serve as the CFO of 100X.

“Together with the rest of the management team and our talented staff members, I will make sure that BitMex continues to deliver great, innovative crypto trading products and a secure and stable trading environment for our clients,” Lutz stated in an emailed statement to the crypto-focused publication.

However, the exchange

Exchange

An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are effectively relevant with real-time pricing.Depending upon where you reside, an exchange may be referred to as a bourse or a share exchange while, as a whole, exchanges are present within the majority of countries. Who is Listed on an Exchange?As trading continues to transition more to electronic exchanges, transactions become more dispersed through varying exchanges. This in turn has caused a surge in the implementation of trading algorithms and high-frequency trading applications. In order for a company to be listed on a stock exchange for example, a company must divulge information such as minimum capital requirements, audited earnings reports, and financial reports.Not all exchanges are created equally, with some outperforming other exchanges significantly. The most high-profile exchanges to date include the New York Stock Exchange (NYSE), the Tokyo Stock Exchange (TSE), the London Stock Exchange (LSE), and the Nasdaq. Outside of trading, a stock exchange may be used by companies aiming to raise capital, this is most commonly seen in the form of initial public offerings (IPOs).Exchanges can now handle other asset classes, given the rise of cryptocurrencies as a more popularized form of trading.

An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are effectively relevant with real-time pricing.Depending upon where you reside, an exchange may be referred to as a bourse or a share exchange while, as a whole, exchanges are present within the majority of countries. Who is Listed on an Exchange?As trading continues to transition more to electronic exchanges, transactions become more dispersed through varying exchanges. This in turn has caused a surge in the implementation of trading algorithms and high-frequency trading applications. In order for a company to be listed on a stock exchange for example, a company must divulge information such as minimum capital requirements, audited earnings reports, and financial reports.Not all exchanges are created equally, with some outperforming other exchanges significantly. The most high-profile exchanges to date include the New York Stock Exchange (NYSE), the Tokyo Stock Exchange (TSE), the London Stock Exchange (LSE), and the Nasdaq. Outside of trading, a stock exchange may be used by companies aiming to raise capital, this is most commonly seen in the form of initial public offerings (IPOs).Exchanges can now handle other asset classes, given the rise of cryptocurrencies as a more popularized form of trading.

Read this Term did not reveal the reason behind the exit of Höptner. He was appointed to the role in January 2021, replacing the interim CEO, Vivien Khoo. He became a full-time CEO after the exchange’s Co-Founder, Arthur Hayes stepped down following criminal charges against him.

Keep Reading

Höptner is an industry expert who previously was the CEO of Börse Stuttgart GmbH and Euwax AG. On top of that, he helped establish Bison, a crypto trading subsidiary of Börse Stuttgart.

Moreover, Lutz has almost two decades of experience working in the financial industry. Previously, he worked for PriceWaterhouseCoopers, Deutsche Börse, Dresdner Bank and a couple of other firms.

A Crypto Derivatives Giant

BitMEX was established in 2014, offering cryptocurrency derivatives to retail investors. The exchange dominated the market for a few years until it was slapped with a series of lawsuits.

The exchange settled charges with CFTC

CFTC

The 1974 Commodity Exchange Act (CEA) in the United States created the Commodity Futures Trading Commission (CFTC). The Commission protects and regulates market activities against manipulation, fraud, and abuse trade practices and promotes fairness in futures contracts. The CEA also included the Sad-Johnson Agreement, which defined the authority and responsibilities for the monitoring of financial contracts between the Commodity Futures Trading Commission and the Securities and Exchange Commission. These are today the largest regulators and authorities in the United States. The Commission works to guarantee that trading on the U.S. futures exchanges are fair and honest and maintain integrity in the marketplace. There are 11 U.S. Futures Exchanges. The Commission is outside of the political realm and is not controlled by any party. To ensure this at no time can more than three members represent the same political party.The CFTC has recently given the go-ahead to a startup exchange that wants to attract individual traders to the risky world of futures. The Small Exchange, headed by a former executive of T.D. Ameritrade Holding Corp., won approval from the Commodity Futures Trading Commission on in 2020 to become the newest U.S. futures exchange. The current exchanges in the U.S. under the regulatory authority of the CFTC include the following: Chicago Board Options Exchange (CBOE) CME Group International Monetary Market (IMM) Chicago Board of Trade (CBOT) Chicago Mercantile Exchange (CME / GLOBEX) New York Mercantile Exchange (NYMEX) and (COMEX) Kansas City Board of Trade (KCBT) NEX Group plc (NXG.L) Intercontinental Exchange (ICE) International Petroleum Exchange (IPE) 2001 New York Board of Trade (NYBOT) 2005 Winnipeg Commodity Exchange (WCE) 2007 TSX Group’s Natural Gas Exchange Partnership 2008 European Climate Exchange 2010 Chicago Climate Exchange (CCE) 2010 NYSE 2013 London International Financial Futures and Options Exchange (LIFFE) Minneapolis Grain Exchange (MGEX) Nadex (formerly HedgeStreet) OneChicago (Single-stock futures (SSF’s) and Futures on ETFs) Nasdaq Futures Exchange (NFX)

The 1974 Commodity Exchange Act (CEA) in the United States created the Commodity Futures Trading Commission (CFTC). The Commission protects and regulates market activities against manipulation, fraud, and abuse trade practices and promotes fairness in futures contracts. The CEA also included the Sad-Johnson Agreement, which defined the authority and responsibilities for the monitoring of financial contracts between the Commodity Futures Trading Commission and the Securities and Exchange Commission. These are today the largest regulators and authorities in the United States. The Commission works to guarantee that trading on the U.S. futures exchanges are fair and honest and maintain integrity in the marketplace. There are 11 U.S. Futures Exchanges. The Commission is outside of the political realm and is not controlled by any party. To ensure this at no time can more than three members represent the same political party.The CFTC has recently given the go-ahead to a startup exchange that wants to attract individual traders to the risky world of futures. The Small Exchange, headed by a former executive of T.D. Ameritrade Holding Corp., won approval from the Commodity Futures Trading Commission on in 2020 to become the newest U.S. futures exchange. The current exchanges in the U.S. under the regulatory authority of the CFTC include the following: Chicago Board Options Exchange (CBOE) CME Group International Monetary Market (IMM) Chicago Board of Trade (CBOT) Chicago Mercantile Exchange (CME / GLOBEX) New York Mercantile Exchange (NYMEX) and (COMEX) Kansas City Board of Trade (KCBT) NEX Group plc (NXG.L) Intercontinental Exchange (ICE) International Petroleum Exchange (IPE) 2001 New York Board of Trade (NYBOT) 2005 Winnipeg Commodity Exchange (WCE) 2007 TSX Group’s Natural Gas Exchange Partnership 2008 European Climate Exchange 2010 Chicago Climate Exchange (CCE) 2010 NYSE 2013 London International Financial Futures and Options Exchange (LIFFE) Minneapolis Grain Exchange (MGEX) Nadex (formerly HedgeStreet) OneChicago (Single-stock futures (SSF’s) and Futures on ETFs) Nasdaq Futures Exchange (NFX)

Read this Term and FinCEN, paying $100 million. Hayes, along with the co-founders, pled guilty to the charges. Each of the co-founders has been ordered to pay $10 million each, while Hayes is facing an additional six-month home detention.

Meanwhile, BitMEX is focused on expansion. It launched spot trading services earlier this year and is eyeing European expansion, gaining a regulatory license in Italy.

The Chief Executive Officer of BitMEX, Alexander Höptner, has stepped down from the apex role just short of a couple of years, The Block reported. The existing CFO, Stephan Lutz has already taken over as the Interim CEO of the crypto company.

Lutz, who joined the crypto exchange in March 2021, will continue to serve as the CFO of 100X.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.

“Together with the rest of the management team and our talented staff members, I will make sure that BitMex continues to deliver great, innovative crypto trading products and a secure and stable trading environment for our clients,” Lutz stated in an emailed statement to the crypto-focused publication.

However, the exchange

Exchange

An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are effectively relevant with real-time pricing.Depending upon where you reside, an exchange may be referred to as a bourse or a share exchange while, as a whole, exchanges are present within the majority of countries. Who is Listed on an Exchange?As trading continues to transition more to electronic exchanges, transactions become more dispersed through varying exchanges. This in turn has caused a surge in the implementation of trading algorithms and high-frequency trading applications. In order for a company to be listed on a stock exchange for example, a company must divulge information such as minimum capital requirements, audited earnings reports, and financial reports.Not all exchanges are created equally, with some outperforming other exchanges significantly. The most high-profile exchanges to date include the New York Stock Exchange (NYSE), the Tokyo Stock Exchange (TSE), the London Stock Exchange (LSE), and the Nasdaq. Outside of trading, a stock exchange may be used by companies aiming to raise capital, this is most commonly seen in the form of initial public offerings (IPOs).Exchanges can now handle other asset classes, given the rise of cryptocurrencies as a more popularized form of trading.

An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are effectively relevant with real-time pricing.Depending upon where you reside, an exchange may be referred to as a bourse or a share exchange while, as a whole, exchanges are present within the majority of countries. Who is Listed on an Exchange?As trading continues to transition more to electronic exchanges, transactions become more dispersed through varying exchanges. This in turn has caused a surge in the implementation of trading algorithms and high-frequency trading applications. In order for a company to be listed on a stock exchange for example, a company must divulge information such as minimum capital requirements, audited earnings reports, and financial reports.Not all exchanges are created equally, with some outperforming other exchanges significantly. The most high-profile exchanges to date include the New York Stock Exchange (NYSE), the Tokyo Stock Exchange (TSE), the London Stock Exchange (LSE), and the Nasdaq. Outside of trading, a stock exchange may be used by companies aiming to raise capital, this is most commonly seen in the form of initial public offerings (IPOs).Exchanges can now handle other asset classes, given the rise of cryptocurrencies as a more popularized form of trading.

Read this Term did not reveal the reason behind the exit of Höptner. He was appointed to the role in January 2021, replacing the interim CEO, Vivien Khoo. He became a full-time CEO after the exchange’s Co-Founder, Arthur Hayes stepped down following criminal charges against him.

Keep Reading

Höptner is an industry expert who previously was the CEO of Börse Stuttgart GmbH and Euwax AG. On top of that, he helped establish Bison, a crypto trading subsidiary of Börse Stuttgart.

Moreover, Lutz has almost two decades of experience working in the financial industry. Previously, he worked for PriceWaterhouseCoopers, Deutsche Börse, Dresdner Bank and a couple of other firms.

A Crypto Derivatives Giant

BitMEX was established in 2014, offering cryptocurrency derivatives to retail investors. The exchange dominated the market for a few years until it was slapped with a series of lawsuits.

The exchange settled charges with CFTC

CFTC

The 1974 Commodity Exchange Act (CEA) in the United States created the Commodity Futures Trading Commission (CFTC). The Commission protects and regulates market activities against manipulation, fraud, and abuse trade practices and promotes fairness in futures contracts. The CEA also included the Sad-Johnson Agreement, which defined the authority and responsibilities for the monitoring of financial contracts between the Commodity Futures Trading Commission and the Securities and Exchange Commission. These are today the largest regulators and authorities in the United States. The Commission works to guarantee that trading on the U.S. futures exchanges are fair and honest and maintain integrity in the marketplace. There are 11 U.S. Futures Exchanges. The Commission is outside of the political realm and is not controlled by any party. To ensure this at no time can more than three members represent the same political party.The CFTC has recently given the go-ahead to a startup exchange that wants to attract individual traders to the risky world of futures. The Small Exchange, headed by a former executive of T.D. Ameritrade Holding Corp., won approval from the Commodity Futures Trading Commission on in 2020 to become the newest U.S. futures exchange. The current exchanges in the U.S. under the regulatory authority of the CFTC include the following: Chicago Board Options Exchange (CBOE) CME Group International Monetary Market (IMM) Chicago Board of Trade (CBOT) Chicago Mercantile Exchange (CME / GLOBEX) New York Mercantile Exchange (NYMEX) and (COMEX) Kansas City Board of Trade (KCBT) NEX Group plc (NXG.L) Intercontinental Exchange (ICE) International Petroleum Exchange (IPE) 2001 New York Board of Trade (NYBOT) 2005 Winnipeg Commodity Exchange (WCE) 2007 TSX Group’s Natural Gas Exchange Partnership 2008 European Climate Exchange 2010 Chicago Climate Exchange (CCE) 2010 NYSE 2013 London International Financial Futures and Options Exchange (LIFFE) Minneapolis Grain Exchange (MGEX) Nadex (formerly HedgeStreet) OneChicago (Single-stock futures (SSF’s) and Futures on ETFs) Nasdaq Futures Exchange (NFX)

The 1974 Commodity Exchange Act (CEA) in the United States created the Commodity Futures Trading Commission (CFTC). The Commission protects and regulates market activities against manipulation, fraud, and abuse trade practices and promotes fairness in futures contracts. The CEA also included the Sad-Johnson Agreement, which defined the authority and responsibilities for the monitoring of financial contracts between the Commodity Futures Trading Commission and the Securities and Exchange Commission. These are today the largest regulators and authorities in the United States. The Commission works to guarantee that trading on the U.S. futures exchanges are fair and honest and maintain integrity in the marketplace. There are 11 U.S. Futures Exchanges. The Commission is outside of the political realm and is not controlled by any party. To ensure this at no time can more than three members represent the same political party.The CFTC has recently given the go-ahead to a startup exchange that wants to attract individual traders to the risky world of futures. The Small Exchange, headed by a former executive of T.D. Ameritrade Holding Corp., won approval from the Commodity Futures Trading Commission on in 2020 to become the newest U.S. futures exchange. The current exchanges in the U.S. under the regulatory authority of the CFTC include the following: Chicago Board Options Exchange (CBOE) CME Group International Monetary Market (IMM) Chicago Board of Trade (CBOT) Chicago Mercantile Exchange (CME / GLOBEX) New York Mercantile Exchange (NYMEX) and (COMEX) Kansas City Board of Trade (KCBT) NEX Group plc (NXG.L) Intercontinental Exchange (ICE) International Petroleum Exchange (IPE) 2001 New York Board of Trade (NYBOT) 2005 Winnipeg Commodity Exchange (WCE) 2007 TSX Group’s Natural Gas Exchange Partnership 2008 European Climate Exchange 2010 Chicago Climate Exchange (CCE) 2010 NYSE 2013 London International Financial Futures and Options Exchange (LIFFE) Minneapolis Grain Exchange (MGEX) Nadex (formerly HedgeStreet) OneChicago (Single-stock futures (SSF’s) and Futures on ETFs) Nasdaq Futures Exchange (NFX)

Read this Term and FinCEN, paying $100 million. Hayes, along with the co-founders, pled guilty to the charges. Each of the co-founders has been ordered to pay $10 million each, while Hayes is facing an additional six-month home detention.

Meanwhile, BitMEX is focused on expansion. It launched spot trading services earlier this year and is eyeing European expansion, gaining a regulatory license in Italy.

Source link

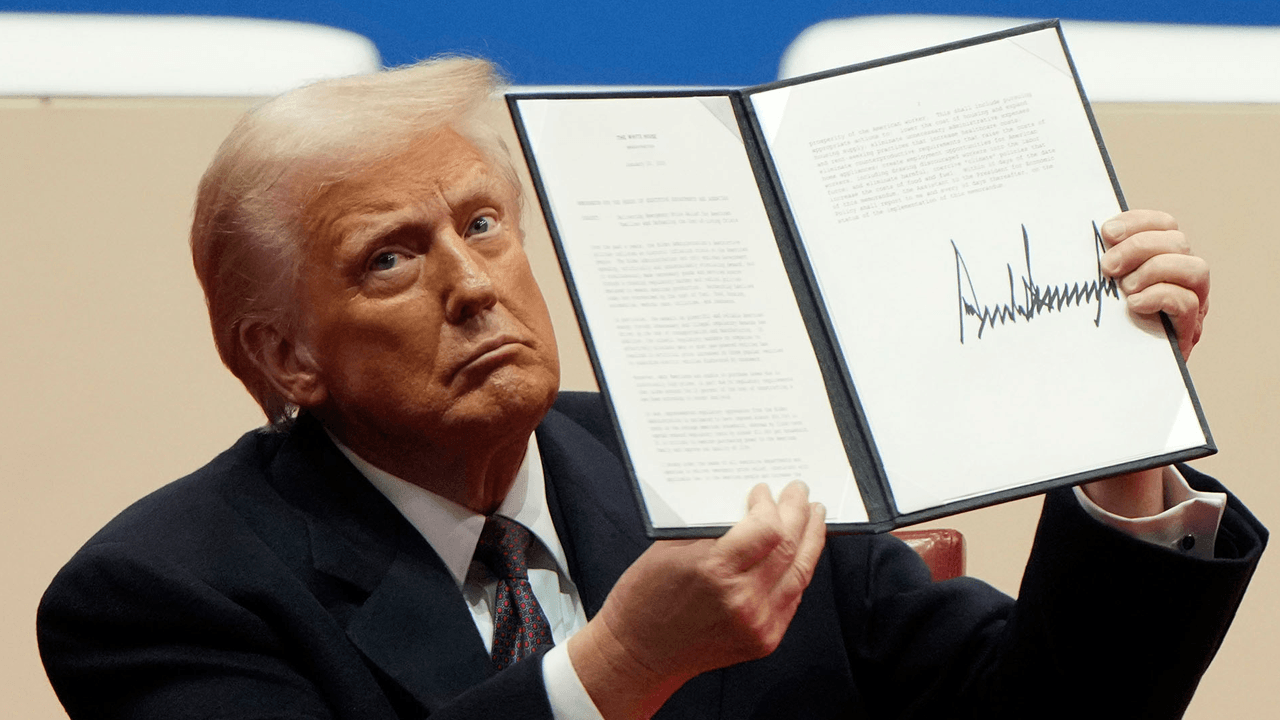

![[LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode? [LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode?](https://99bitcoins.com/wp-content/uploads/2025/08/IMG_0834-scaled.png)