Few assets

garner as much attention and scrutiny as Bitcoin in the ever-changing

cryptocurrency world. The previous month has demonstrated the intrinsic

volatility of this digital money, leaving both investors and analysts befuddled

by its volatile price movements. In this article, we look at Bitcoin’s recent

wild journey, evaluating the reasons that have contributed to its volatility

and examining the consequences for the broader crypto market.

Discover StealthEX.io – the future of cryptocurrency. Swap instantly across 1000+ coins, no sign-up, secure, and private. Dive into the new age of crypto!

Price Swings

on a Roller-Coaster

The

cryptocurrency market is infamous for its wild price changes, and Bitcoin

is frequently at the epicenter of these movements. Bitcoin’s price has

fluctuated dramatically over the last month, leaving investors both excited and

concerned. This wild ride serves as a reminder of the unusual character of

cryptocurrency markets, where emotion and external factors can have a large

impact on pricing in a short period of time.

Is Bitcoin’s

Low Volatility Pointing to a Potential Further Decline?

Bitcoin and

various cryptocurrencies are currently experiencing low volatility, a pattern

that has preceded further price declines in recent times. Bitcoin’s price has

remained relatively flat at around $25,750 over the past 24 hours, staying

below the $26,000 level, which has served as a key support in the previous

month. This

comes after a brief surge above $28,000 following a pro-crypto court

ruling, which proved to be short-lived.

Bitcoin’s

volatility has reached record lows in recent months, and it appears to be

returning to that pattern, lacking the dynamism seen in traditional markets

like the Dow Jones Industrial Average and S&P 500.

Keep Reading

However,

cryptocurrencies continue to be influenced by the same macroeconomic factors

affecting equities. Concerns over resurging inflation and its impact on

interest rates, which, in turn, affect the demand for riskier assets, have put

pressure on the cryptocurrency market.

The Causes

of the Volatility

Bitcoin’s

volatility is caused by a variety of causes, and recent events have highlighted

some of the most important ones. Bitcoin’s price trajectory can be influenced

by regulatory developments, market sentiment, macroeconomic trends, and

technological improvements.

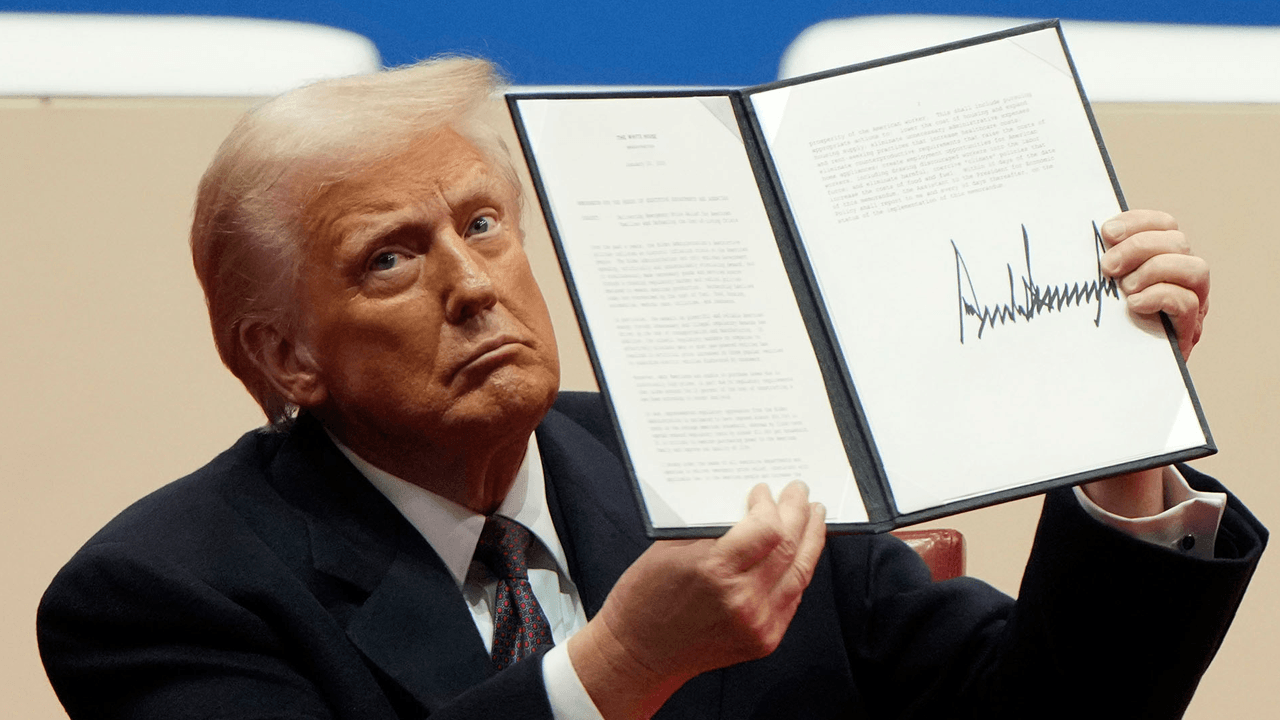

Uncertainty

in Regulation

Government

regulatory announcements or crackdowns can have a significant impact on the

cryptocurrency market. Speculation about prospective regulatory changes might

cause market volatility and sell-offs. For example, rumors of heightened

regulatory scrutiny in a major market can cause investors to panic sell,

resulting in dramatic price reductions.

Market

Attitudes

Investor

attitude fluctuations frequently impact cryptocurrency markets. Positive news,

such as institutional adoption or endorsements from high-profile personalities,

can cause price spikes to occur quickly. Negative news, such as security

breaches or legal issues, might, on the other hand, cause sell-offs and

significant price decreases.

Trends in

Macroeconomics

Bitcoin’s value

is also affected by broader economic factors. During periods of economic

uncertainty, investors may regard Bitcoin as a safe haven against traditional

financial markets, resulting in greater demand and price increases. In

contrast, during periods of economic optimism, Bitcoin’s price may fall as

investors shift toward riskier assets.

Technological

Progress

Bitcoin’s price

can be influenced by technological advancements inside the bitcoin ecosystem.

Updates to the Bitcoin network, scalability enhancements, and breakthroughs in

security protocols can all have an impact on investor confidence and price

stability.

Consequences

for the Crypto Market

The dramatic

price oscillations of Bitcoin might have repercussions throughout the

cryptocurrency industry. Alternative cryptocurrencies, or altcoins, frequently

follow Bitcoin’s lead, with their prices corresponding to Bitcoin’s changes.

This connection arises from Bitcoin’s prominence and status as the crypto

space’s benchmark.

When the price

of Bitcoin fluctuates significantly, it might increase trading activity across

all cryptocurrencies. Traders may attempt to profit from short-term price

movements, increasing volatility throughout the market. Furthermore,

significant price movements in Bitcoin can cause investors to rethink their

positions in other cryptocurrencies, potentially causing cascading impacts on

their pricing.

Getting

Through the Volatility

While Bitcoin’s

volatility brings both opportunities and threats, investors must proceed with

caution and knowledge.

A variety of

factors can influence short-term price fluctuations, many of which are

difficult to forecast. As a result, navigating the unpredictable cryptocurrency

market requires a long-term investing strategy underpinned by comprehensive

research and risk management.

A Look Into

the Future

Bitcoin’s

volatility may progressively reduce as cryptocurrency marketplaces develop and

regulatory clarity improves. Participation by institutions, regulatory

acceptance, and widespread adoption could all contribute to a more stable price

environment. However, due to the speculative character of cryptocurrencies,

some volatility is expected to endure.

Conclusion

Bitcoin’s

recent rapid rise highlights the cryptocurrency market’s unique difficulties

and prospects. While its volatility can be intimidating, it also exposes the

possibility of large gains and losses in a short period of time. Traders and

investors must remain cautious, remaining educated about the factors

influencing Bitcoin’s price movements and taking into account their risk tolerance

and investment objectives. As the cryptocurrency ecosystem evolves, the lessons

acquired from Bitcoin’s wild ride will surely impact market participants’

strategies.

Few assets

garner as much attention and scrutiny as Bitcoin in the ever-changing

cryptocurrency world. The previous month has demonstrated the intrinsic

volatility of this digital money, leaving both investors and analysts befuddled

by its volatile price movements. In this article, we look at Bitcoin’s recent

wild journey, evaluating the reasons that have contributed to its volatility

and examining the consequences for the broader crypto market.

Price Swings

on a Roller-Coaster

The

cryptocurrency market is infamous for its wild price changes, and Bitcoin

is frequently at the epicenter of these movements. Bitcoin’s price has

fluctuated dramatically over the last month, leaving investors both excited and

concerned. This wild ride serves as a reminder of the unusual character of

cryptocurrency markets, where emotion and external factors can have a large

impact on pricing in a short period of time.

Discover StealthEX.io – the future of cryptocurrency. Swap instantly across 1000+ coins, no sign-up, secure, and private. Dive into the new age of crypto!

Is Bitcoin’s

Low Volatility Pointing to a Potential Further Decline?

Bitcoin and

various cryptocurrencies are currently experiencing low volatility, a pattern

that has preceded further price declines in recent times. Bitcoin’s price has

remained relatively flat at around $25,750 over the past 24 hours, staying

below the $26,000 level, which has served as a key support in the previous

month. This

comes after a brief surge above $28,000 following a pro-crypto court

ruling, which proved to be short-lived.

Bitcoin’s

volatility has reached record lows in recent months, and it appears to be

returning to that pattern, lacking the dynamism seen in traditional markets

like the Dow Jones Industrial Average and S&P 500.

Keep Reading

However,

cryptocurrencies continue to be influenced by the same macroeconomic factors

affecting equities. Concerns over resurging inflation and its impact on

interest rates, which, in turn, affect the demand for riskier assets, have put

pressure on the cryptocurrency market.

The Causes

of the Volatility

Bitcoin’s

volatility is caused by a variety of causes, and recent events have highlighted

some of the most important ones. Bitcoin’s price trajectory can be influenced

by regulatory developments, market sentiment, macroeconomic trends, and

technological improvements.

Uncertainty

in Regulation

Government

regulatory announcements or crackdowns can have a significant impact on the

cryptocurrency market. Speculation about prospective regulatory changes might

cause market volatility and sell-offs. For example, rumors of heightened

regulatory scrutiny in a major market can cause investors to panic sell,

resulting in dramatic price reductions.

Market

Attitudes

Investor

attitude fluctuations frequently impact cryptocurrency markets. Positive news,

such as institutional adoption or endorsements from high-profile personalities,

can cause price spikes to occur quickly. Negative news, such as security

breaches or legal issues, might, on the other hand, cause sell-offs and

significant price decreases.

Trends in

Macroeconomics

Bitcoin’s value

is also affected by broader economic factors. During periods of economic

uncertainty, investors may regard Bitcoin as a safe haven against traditional

financial markets, resulting in greater demand and price increases. In

contrast, during periods of economic optimism, Bitcoin’s price may fall as

investors shift toward riskier assets.

Technological

Progress

Bitcoin’s price

can be influenced by technological advancements inside the bitcoin ecosystem.

Updates to the Bitcoin network, scalability enhancements, and breakthroughs in

security protocols can all have an impact on investor confidence and price

stability.

Consequences

for the Crypto Market

The dramatic

price oscillations of Bitcoin might have repercussions throughout the

cryptocurrency industry. Alternative cryptocurrencies, or altcoins, frequently

follow Bitcoin’s lead, with their prices corresponding to Bitcoin’s changes.

This connection arises from Bitcoin’s prominence and status as the crypto

space’s benchmark.

When the price

of Bitcoin fluctuates significantly, it might increase trading activity across

all cryptocurrencies. Traders may attempt to profit from short-term price

movements, increasing volatility throughout the market. Furthermore,

significant price movements in Bitcoin can cause investors to rethink their

positions in other cryptocurrencies, potentially causing cascading impacts on

their pricing.

Getting

Through the Volatility

While Bitcoin’s

volatility brings both opportunities and threats, investors must proceed with

caution and knowledge.

A variety of

factors can influence short-term price fluctuations, many of which are

difficult to forecast. As a result, navigating the unpredictable cryptocurrency

market requires a long-term investing strategy underpinned by comprehensive

research and risk management.

A Look Into

the Future

Bitcoin’s

volatility may progressively reduce as cryptocurrency marketplaces develop and

regulatory clarity improves. Participation by institutions, regulatory

acceptance, and widespread adoption could all contribute to a more stable price

environment. However, due to the speculative character of cryptocurrencies,

some volatility is expected to endure.

Conclusion

Bitcoin’s

recent rapid rise highlights the cryptocurrency market’s unique difficulties

and prospects. While its volatility can be intimidating, it also exposes the

possibility of large gains and losses in a short period of time. Traders and

investors must remain cautious, remaining educated about the factors

influencing Bitcoin’s price movements and taking into account their risk tolerance

and investment objectives. As the cryptocurrency ecosystem evolves, the lessons

acquired from Bitcoin’s wild ride will surely impact market participants’

strategies.