IPOs send strong signals.

Earning a place on a stock market index, which holds so much weight across the

traditional finance sector, evidences your position as a successful, mainstream

and compliant business. These are the signals crypto innovators want to send

this year, and they’ll turn to IPOs to do so. In fact, soon, I believe we’ll

see more crypto IPOs than ever before.

Circle Sets the Stage

We’re already seeing the

trend set in. Major stablecoin issuer Circle has already listed on the

NYSE recently, and others are gearing up to do the same. Ripple, Kraken and

Consensys are among those who could be next in line.

Historically, IPOs have

remained a far-off prospect for many crypto players. Regulatory barriers halted

progress for the coin issuers, exchanges and mining firms that keep the crypto

machine moving. They made taking the final leap toward traditional stock

markets far more difficult.

As a result, many of the

biggest industry names are absent from the most celebrated indexes. While

Coinbase took its place on the Nasdaq in 2021, it did so via a Direct Public

Offering and remains the only major crypto firm to have listed, until the latest listing of Circle.

Read more: Circle Shares Soar 235% on First Day of NYSE Trading

1/ Circle’s IPO is a milestone not just for one company but for the whole crypto application layer.

“Apps” like Circle are now out-earning the very blockchains they’re built on.

Let’s look at the top 20 revenue-generating crypto projects 👇 pic.twitter.com/O0CQKOWZM2

— Kai Wu (@ckaiwu) June 5, 2025

Regulation Is Easing Up

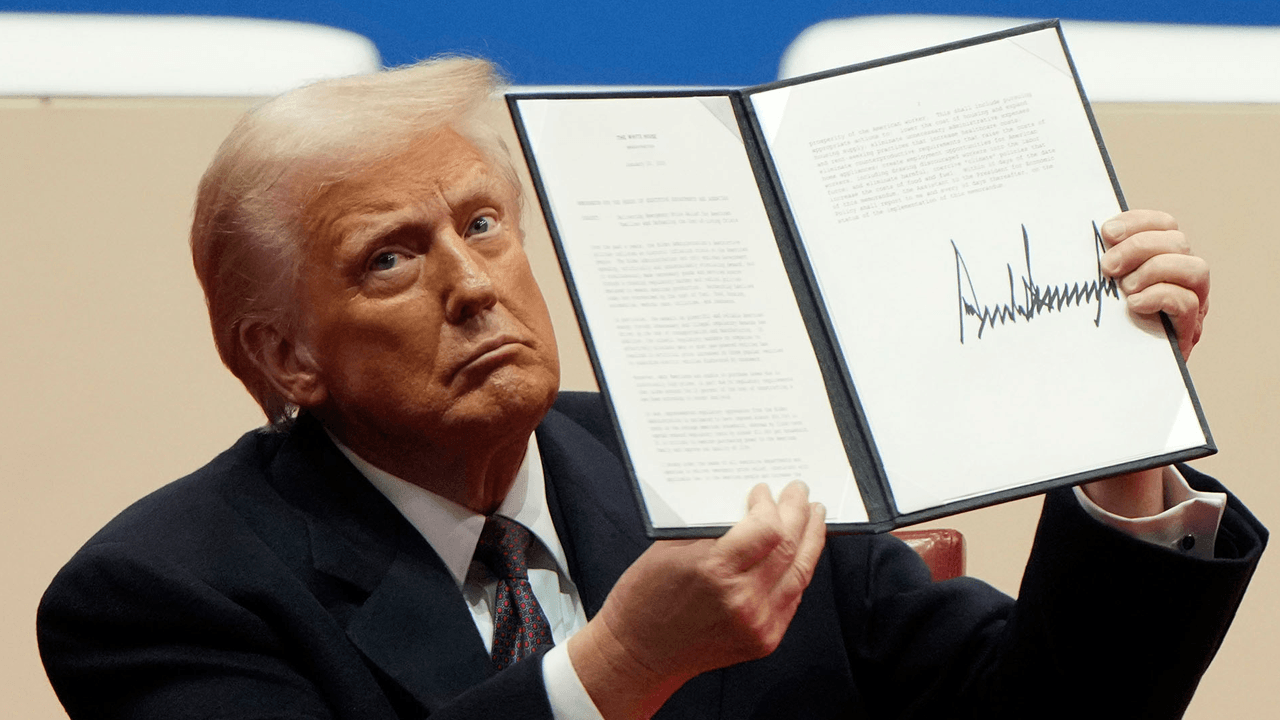

But all that is set to

change. We’re seeing a new, far more positive approach to digital assets sweep

across the States, and it’s smashing down the hurdles to IPO.

Regulatory bodies are easing

up on what has been, for many years, an intense and relentless pursuit of

digital asset firms. Trump has appointed Paul Atkins, who is known to look upon

cryptocurrencies favorably, as Chair of the SEC, and we have already seen

significant changes implemented at the agency.

For starters, it is now home

to the crypto task force – a working group hoping to drive forward crypto

regulation. The task force is speaking to industry figures to establish clearer

processes and classification guidelines so that firms can innovate within

transparent parameters.

That means they’ll be able to

grow with confidence – confidence that they can innovate without any blockers

or regulatory hurdles.

But it’s not just regulatory

clarity firms are benefitting from. Regulators are also backing off

pre-existing cases altogether.

Since the start of 2025, the

SEC has dropped a staggering number of cases, including one of its most

prominent lawsuits against Ripple. The case raged on for four years but has now been abandoned,

sending a strong message that the agency’s once-fierce glare has eased off.

This positive regulatory

environment is critical to crypto firms’ journeys toward the stock market. To

float in the US, firms must file their registration statement with the SEC. The fact that it now won’t come down unnecessarily

heavy-handedly on firms’ business models, risk factors and corporate governance

is crucial.

It doesn’t stop there: the

SEC’s change of heart has been mirrored by other government bodies, with the

Department of Justice choosing to disband its cryptocurrency crime unit. It all amounts to a regulatory reset that has

unfolded since Trump stepped back into the White House. Regardless of your

views on the President, there’s no doubt he has created a far more positive and

productive environment for the crypto sector.

And it’s all happening at the

perfect time. Over the last five years, crypto’s institutional adoption has

gained rapid momentum – and firms are in an even stronger position to list as a

result.

Institutions have Embraced Crypto

Once upon a time, digital

assets were the ugly duckling of the financial world. They were shunned by many

institutional investors who felt they were too much of an unknown, too risky

and volatile to bring into their portfolios. But, as of January 2025, 86% of

institutional investors had exposure to digital assets or planned to make

digital asset allocations later in the year.

From asset managers to hedge

funds and family offices, TradFi has slowly moved towards its digital

counterpart. This move has been driven by the SEC’s approval of spot Bitcoin

and Ether ETFs, which came through in 2024 and marked a pivotal moment for cryptocurrencies.

In their first year of trading, spot Bitcoin ETFs recorded massive net inflows

of $36.2 billion – they have undoubtedly attracted some of the naysayers to the crypto market.

Read more: US President Trump’s Social Media Firm to Launch a Bitcoin ETF

With the entrance of

institutional investors, crypto firms have secured another vital piece of the

IPO puzzle. They need buy-in from these investors to float, and they now have

that in abundance.

The three pivotal IPO

components are finally in place: the need for crypto firms to send strong

compliance signals, a more favorable regulatory environment and institutional

investors’ approval.

The door to IPOs has been shut for far too long, but trust me when I say it’s about to be flung

open. We’ll see a crypto firm IPO rush in 2025 – Circle’s filing is just the

beginning.

IPOs send strong signals.

Earning a place on a stock market index, which holds so much weight across the

traditional finance sector, evidences your position as a successful, mainstream

and compliant business. These are the signals crypto innovators want to send

this year, and they’ll turn to IPOs to do so. In fact, soon, I believe we’ll

see more crypto IPOs than ever before.

Circle Sets the Stage

We’re already seeing the

trend set in. Major stablecoin issuer Circle has already listed on the

NYSE recently, and others are gearing up to do the same. Ripple, Kraken and

Consensys are among those who could be next in line.

Historically, IPOs have

remained a far-off prospect for many crypto players. Regulatory barriers halted

progress for the coin issuers, exchanges and mining firms that keep the crypto

machine moving. They made taking the final leap toward traditional stock

markets far more difficult.

As a result, many of the

biggest industry names are absent from the most celebrated indexes. While

Coinbase took its place on the Nasdaq in 2021, it did so via a Direct Public

Offering and remains the only major crypto firm to have listed, until the latest listing of Circle.

Read more: Circle Shares Soar 235% on First Day of NYSE Trading

1/ Circle’s IPO is a milestone not just for one company but for the whole crypto application layer.

“Apps” like Circle are now out-earning the very blockchains they’re built on.

Let’s look at the top 20 revenue-generating crypto projects 👇 pic.twitter.com/O0CQKOWZM2

— Kai Wu (@ckaiwu) June 5, 2025

Regulation Is Easing Up

But all that is set to

change. We’re seeing a new, far more positive approach to digital assets sweep

across the States, and it’s smashing down the hurdles to IPO.

Regulatory bodies are easing

up on what has been, for many years, an intense and relentless pursuit of

digital asset firms. Trump has appointed Paul Atkins, who is known to look upon

cryptocurrencies favorably, as Chair of the SEC, and we have already seen

significant changes implemented at the agency.

For starters, it is now home

to the crypto task force – a working group hoping to drive forward crypto

regulation. The task force is speaking to industry figures to establish clearer

processes and classification guidelines so that firms can innovate within

transparent parameters.

That means they’ll be able to

grow with confidence – confidence that they can innovate without any blockers

or regulatory hurdles.

But it’s not just regulatory

clarity firms are benefitting from. Regulators are also backing off

pre-existing cases altogether.

Since the start of 2025, the

SEC has dropped a staggering number of cases, including one of its most

prominent lawsuits against Ripple. The case raged on for four years but has now been abandoned,

sending a strong message that the agency’s once-fierce glare has eased off.

This positive regulatory

environment is critical to crypto firms’ journeys toward the stock market. To

float in the US, firms must file their registration statement with the SEC. The fact that it now won’t come down unnecessarily

heavy-handedly on firms’ business models, risk factors and corporate governance

is crucial.

It doesn’t stop there: the

SEC’s change of heart has been mirrored by other government bodies, with the

Department of Justice choosing to disband its cryptocurrency crime unit. It all amounts to a regulatory reset that has

unfolded since Trump stepped back into the White House. Regardless of your

views on the President, there’s no doubt he has created a far more positive and

productive environment for the crypto sector.

And it’s all happening at the

perfect time. Over the last five years, crypto’s institutional adoption has

gained rapid momentum – and firms are in an even stronger position to list as a

result.

Institutions have Embraced Crypto

Once upon a time, digital

assets were the ugly duckling of the financial world. They were shunned by many

institutional investors who felt they were too much of an unknown, too risky

and volatile to bring into their portfolios. But, as of January 2025, 86% of

institutional investors had exposure to digital assets or planned to make

digital asset allocations later in the year.

From asset managers to hedge

funds and family offices, TradFi has slowly moved towards its digital

counterpart. This move has been driven by the SEC’s approval of spot Bitcoin

and Ether ETFs, which came through in 2024 and marked a pivotal moment for cryptocurrencies.

In their first year of trading, spot Bitcoin ETFs recorded massive net inflows

of $36.2 billion – they have undoubtedly attracted some of the naysayers to the crypto market.

Read more: US President Trump’s Social Media Firm to Launch a Bitcoin ETF

With the entrance of

institutional investors, crypto firms have secured another vital piece of the

IPO puzzle. They need buy-in from these investors to float, and they now have

that in abundance.

The three pivotal IPO

components are finally in place: the need for crypto firms to send strong

compliance signals, a more favorable regulatory environment and institutional

investors’ approval.

The door to IPOs has been shut for far too long, but trust me when I say it’s about to be flung

open. We’ll see a crypto firm IPO rush in 2025 – Circle’s filing is just the

beginning.