$ADBE has set the standard for creative software, driving professional design and video editing with tools like Photoshop, Illustrator, and Premiere Pro. Its innovations, like Firefly and AI-powered features in Acrobat, aim to transform content creation. Yet, despite strong market leadership and a reliable subscription revenue model, Adobe has lagged behind last year’s tech rally, making it one of the weakest-performing mega cap tech stocks.

Why is Adobe struggling compared to its peers, and is this AI-related stock worth adding to the portfolio in 2025?

Key Financials: How Adobe’s Subscription Model Powers Growth

Key Revenue Drivers

Adobe operates on a subscription-based model, with subscriptions contributing 95% of its revenue—a transformation initiated with the launch of Creative Cloud in 2012. Previously, Adobe sold around 3 million units annually via perpetual licensing. The shift to subscriptions revolutionized Adobe’s business, delivering predictable revenue streams and faster growth. Its revenue is driven by three core segments:

Creative Cloud: The largest segment, contributing 60% of revenue, remains pivotal. Tools like Photoshop and Premiere Pro dominate their industries, while AI features like Adobe Firefly justify premium pricing.

Document Cloud: Making up 25% of revenue, it benefits from Acrobat’s PDF market leadership and growing demand for Adobe Sign, fueled by the shift to digital workflows and remote work.

Experience Cloud: Comprising 15% of revenue, it targets enterprise needs in marketing, analytics, and e-commerce, with scalability enhanced by partnerships with Microsoft Azure and AWS.

Adobe’s annual revenue grew from $13 billion in 2020 to $19.4 billion in 2023 (CAGR 14.7%), slower than its remarkable growth from $4.8 billion to $12.87 billion (CAGR 22.1%) between 2015 and 2020, driven by rapid SaaS adoption. Despite this moderation, Adobe’s innovation and strategic partnerships position it for sustained growth.

In their Q4 2024 earnings call, CEO Shantanu Narayen stated, “Adobe delivered record FY24 revenue, demonstrating strong demand and the mission-critical role Creative Cloud, Document Cloud and Experience Cloud play in fueling the AI economy. Our highly differentiated technology platforms, rapid pace of innovation, diversified go-to-market and the integration of our clouds position us for a great year ahead.”

Next earnings report is expected to be released on Wednesday, 12th of March.

Strong Margins, Stronger Future

Adobe’s profitability underscores its enduring strength. The company has shown consistent improvement in this area since they shifted to the subscription business model. The company’s gross margin consistently exceeds 85%, driven by the low costs of delivering digital products while maintaining high subscription revenues. Operating margins are equally strong, consistently exceeding 35%. Adobe achieves this by keeping expenses under control while still investing heavily in innovation, such as AI-powered tools and cloud-based services. Net profit margins further highlight Adobe’s financial strength, with the most recent quarter delivering a margin of 25.59%, meaning it retained more than a quarter of its total revenue as profit after all expenses.

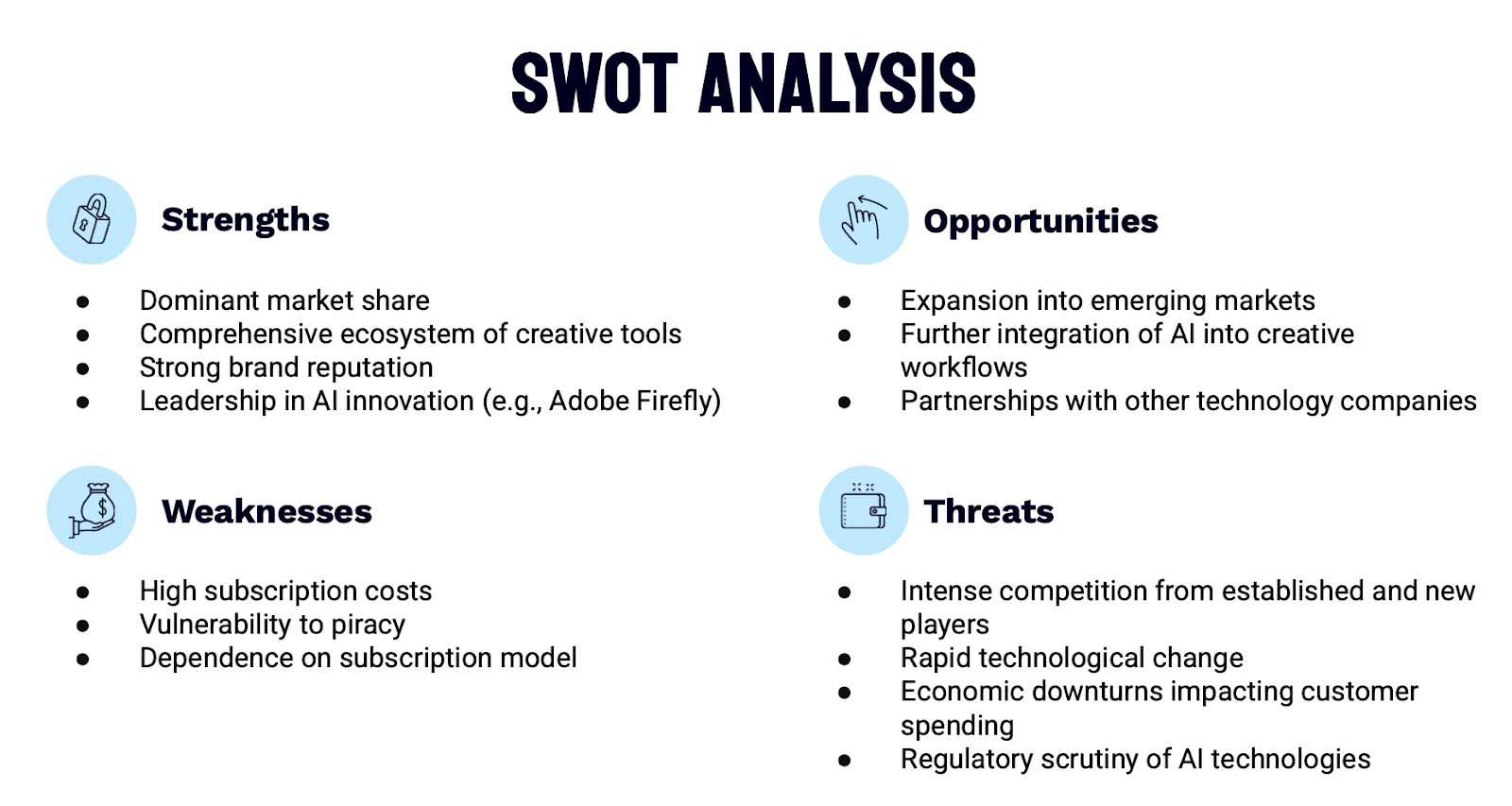

Adobe’s Edge in a Competitive Creative Software Landscape

Adobe leads the creative software market with a dominant 42% share, powered by flagship products like Photoshop and Creative Cloud. The competitive environment, however, is intense. Microsoft, Corel, Autodesk, and Canva challenge Adobe with more affordable or specialized tools, but Adobe stands out with its comprehensive ecosystem, strong brand, and advanced AI integration. The overall creative software industry is projected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2034 (source), driven by technological advancements and increasing demand for digital content creation tools, and Adobe is positioned to capture a big portion of this growth.

Competitive Snapshot:

Canva: Offers a user-friendly interface and a freemium model, making it popular among non-professional users and small businesses. Its simplicity and affordability have allowed it to gain significant market share, particularly in the social media graphics and presentation design space.

Corel: Provides a range of creative software, including CorelDRAW, which competes with Adobe Illustrator. Corel’s products are often offered at a lower price point than Adobe’s, making them an attractive option for budget-conscious users.

Autodesk: Known for its professional-grade 3D modeling and CAD software, Autodesk competes with Adobe in specific areas such as video editing (with products like Smoke) and design (with products like Sketchbook).

How Adobe is Winning the AI Race in Creative Software

Adobe isn’t just jumping on the AI bandwagon. They’re changing how people create using their tools like Photoshop and Illustrator. Their AI tool, Firefly, is built right into their software, making it easy for artists to use. What truly sets Firefly apart from other generative AI tools is its ethical approach—using licensed content to ensure copyright safety, a critical differentiator in a crowded and sometimes murky AI landscape. With over 12 billion images already generated, Firefly is making waves, even if its financial impact is modest for now due to high R&D costs, competition from more affordable AI tools, and Adobe’s focus on embedding AI into its ecosystem rather than direct monetization. Through this strategy, they are focusing more on long-term growth and user retention, reinforcing Adobe’s position as the top choice for professionals while adapting to the growing generative AI market.

Adobe’s AI Monetization Strategy:

Adobe’s approach to monetizing AI is multi-faceted:

Premium Features: Integrating AI-powered features into existing Creative Cloud applications and charging a premium for access.

New Product Offerings: Launching new AI-driven tools and services, such as Firefly, as standalone products or add-ons to existing subscriptions.

Increased Subscription Prices: Justifying higher subscription prices by offering enhanced functionality and value through AI-powered capabilities.

Threats to Adobe’s Dominance:

Intense Competition: Adobe faces a multi-pronged assault. Established rivals like Autodesk and Corel continue to challenge them, while newcomers like Canva offer compelling alternatives at more accessible price points. This competitive pressure limits Adobe’s pricing power and threatens to erode market share.

Piracy and Security Concerns: Widespread piracy of Adobe software not only impacts revenue but also poses significant security risks to users.

Pricing Pressure: High subscription costs can cut off small businesses and casual users, pushing them toward cheaper alternatives.

Rapid Technological Change: The rapid evolution of generative AI and cloud-based solutions demands constant innovation from Adobe. Failing to adapt quickly could leave them vulnerable to disruption and jeopardize their market leadership.

Why Adobe Could Be a Gem at Its Current Valuation

Adobe’s current valuation metrics may not appear as a bargain initially but reveal significant potential when placed in context. At an EV/EBITDA multiple of 17x, Adobe trades below its 10-year average of 23x, reflecting a discount on its historical valuation. Its P/FCF ratio of 20x, compared to the 10-year mean of 30x, further highlights its ability to generate robust cash flows—an attribute of its subscription-based business model.

The company’s competitive moat reinforces its value. Adobe dominates with industry-standard tools like Photoshop, Illustrator, and Premiere Pro, ensuring high switching costs and consistent recurring revenues. These products anchor its ecosystem, making Adobe indispensable for professionals and enterprises alike. Innovations like Firefly and its commitment to ethical AI practices strengthen its position, allowing it to stay ahead in a rapidly evolving market.

After the last earnings report, the stock experienced a pull back due to 2025 Q1 guidance of $5.63–$5.68 billion, slightly below Wall Street’s $5.73 billion forecast. This reaction overlooks Adobe’s track record of meeting or exceeding annual projections and its positioning to capitalize on transformative trends like AI and digital transformation.

Potential Scenarios

Positive Scenario: Leveraging its leadership in AI and successful innovations like Firefly, Adobe’s valuation could return to its 10-year EV/EBITDA average of 23x. This could result in 30-35% upside, driven by stronger growth and investor confidence. Successful integration of AI across its product line and further expansion into enterprise solutions would fuel this scenario.

Neutral Scenario: If Adobe maintains steady growth and meets its guidance, valuation recovery to slightly above current levels could deliver 10-15% gains, reflecting resilience without exceeding expectations. This assumes no major competitive disruptions and continued, albeit moderate, growth in key segments.

Negative Scenario: Challenges like slowing growth or intensified competition could compress multiples further, resulting in a 10-20% decline. Failure to effectively monetize AI investments or significant market share loss to competitors like Canva could trigger this.

Conclusion

Adobe’s combination of a discounted valuation, robust fundamentals, and a competitive moat positions it as a compelling opportunity despite short-term headwinds. With strong execution and leadership in transformative trends, Adobe is well-equipped to sustain its premium status while shaping the future of creative softwares. For those interested in a deeper dive into Adobe business, don’t miss our Stock Break episode dedicated to the company.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

![[LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode? [LIVE] Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode?](https://99bitcoins.com/wp-content/uploads/2025/08/IMG_0834-scaled.png)