#BItcoin #SupplyCrunch #Halving #ETFs $MSTR #Scarcity #PricePredictions

THIS VIDEO IS BASED ON THIS PAPER

👋 JOIN THE FAMILY:

📈 IA MODELS:

📬 IA NEWSLETTER:

🪙 IA CRYPTO COMPENDIUM:

👉Featured in this video:

◆LILO Layer In, Layer Out:

◆MSTR Calculator (join “Investor” membership level on Patreon to use):

DISCLAIMER: InvestAnswers does not provide financial, investment, tax, or legal advice. None of the content on the InvestAnswers channels is financial, investment, tax, or legal advice and should not be taken as such; the content is intended only for educational and entertainment purposes. InvestAnswers (James) shares some of his trades as learning examples but they are only relevant to his specific portfolio allocation, risk tolerance & financial expertise, may not constitute a comprehensive or complete discussion of such topics, and should not be emulated. The content of this video is solely the opinion(s) of the speaker who is not a licensed financial advisor or registered investment advisor. Trading equities or cryptocurrencies poses considerable risk of loss. Kindly use your judgment and do your own research at all times. You are solely responsible for your own financial, investing, and trading decisions.

0:00 Introduction

2:24 Inspiration for this Video is MILK ROAD

3:14 ETF Flow after 18 Days

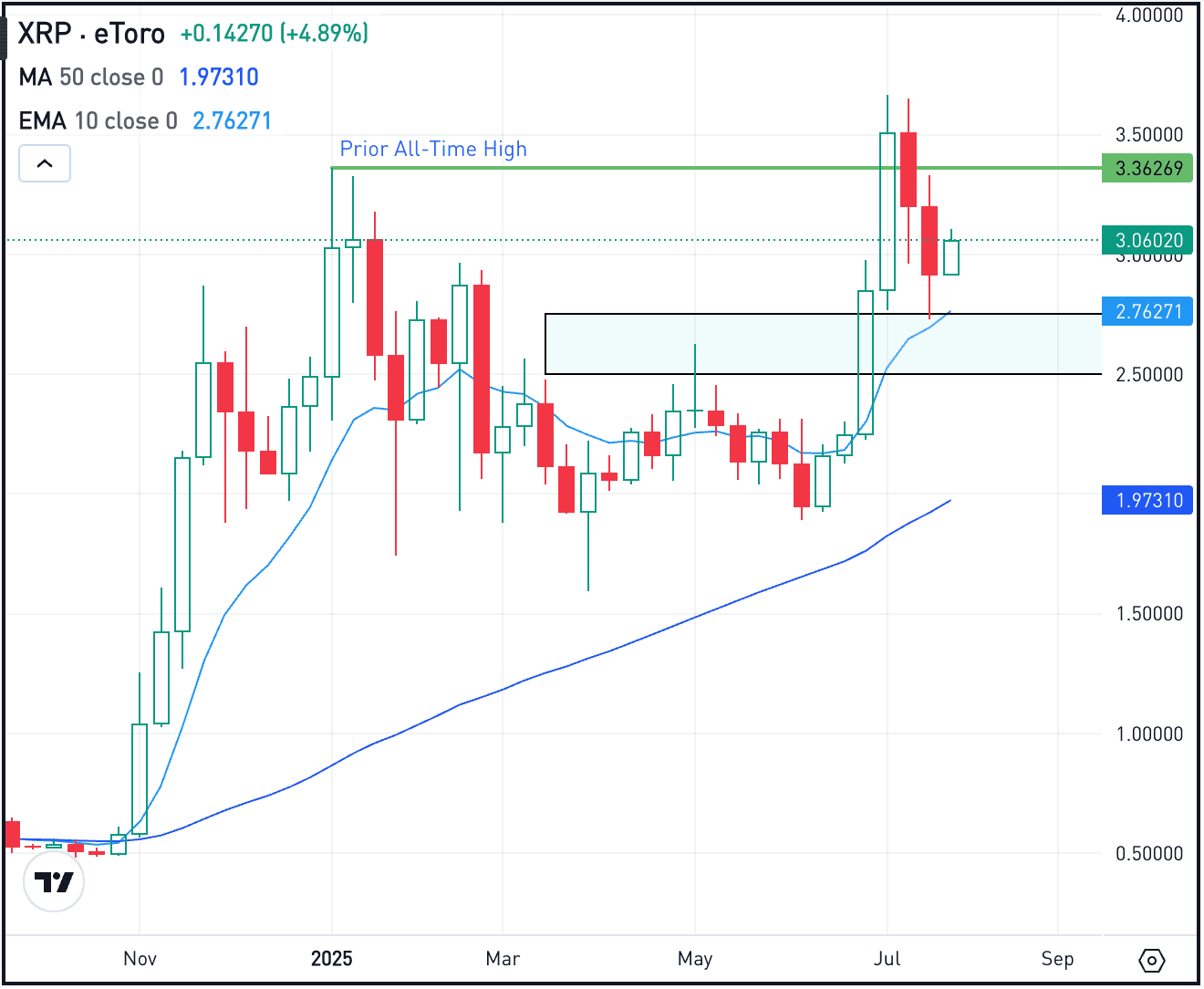

3:45 Total Bitcoin Production in 2024

4:32 Total Bitcoin Production Next 12 Months

5:19 ETF Consumption Scenarios – Next 12 Mths

6:37 $GGLD Gold ETF – Up Only for 8 Years

7:16 Halving Clock – 69 Days To Go

7:27 Bitcoin History and the 90 Day Rule

13:54 Back to Brass Tacks

14:01 Money Flow with Avg $80,000 BTC

16:43 BTC on LILO – Target $126K

17:43 Halving Reminder

18:26 Big Bitcoin Takeaways

20:23 Reminder: 1st Halving w Diminishing Supply

20:48 MicroStrategy buys $37m more BTC

21:44 MSTR Update – If BTC goes to 130K

22:54 MSTR on LILO Target $1,213

23:19 ETF Live Volume Update

24:20 Spot BTC ETF Fee Update

24:55 WEN SUPPLY SHOCK

25:26 Sunny Days Ahead – Future is Bright!

source

Hi from Singapore James, just signed up in patreon yesterday and can't wait to explore discord and more, really appreciate your content!

As a newbie about to invest, you must have these three things in mind

1. Have a long term mindset.

2. Be willing to take risk.

3. Be careful on money usage, if you're not spending to earn back, then stop spending.

4. Never claim to know – Ask questions and it's best you work with a financial advisor

Hey James, any plans to degen into WEN?

Yeah, yeah, yeah James; hopium as ever! Really makes me laugh you No-Mark YTbers actually think you're something … 🤣

Thank you James, you do the work and that is recognized and appreciated 😊

So good! All of your content is just solid! Thank you

James, I’ve been watching this channel for 3+ yrs. As always, the information you’ve provided are very valuable to us. This particular episode is absolutely the most important ‘90 days before and 90 days after’ Thank you so much!!! 🙏🙏🙏

Would be very funny if your video was "July 16, 2024". Three seconds and then fade to black. April Fools quickly approaching…

yOU ALWAYS HAVE AN INTERESTING PERSPECTIVE THANKYOU !!

It was longer than 90 days after halving before BTC hit $50K in 2021

WTF James. Why have you got a scam video advert re: Michael Saylor giveaway on your site ???????????????? Doesnt look good for your rep bruv.

The same time I get lambo.

What are your thoughts on Minors? MARA, RIOT and WULF?

Incredible clarity and perspective. Effectively bitcoin as a whole isn’t changing hands much, where there is a buyer for bitcoin being sold. Rue one thing is that we are already at 1 trillion market cap. If we 50x’ed that would be 50 trillion, 4x worth gold. It would take mountains to move that amount of cash, never mind in a 1.5 year bull run, I am very interested nonetheless on what could happen

that's just wrong. Bitcoin tops 15 to 18 months after the halving

Considering the correct price of $11,737 for the date 90 days after the May 11, 2020 halving (August 9, 2020), the gain was 33%. So the average gain of BTC 90 days after the 2016 and 2020 halvings was 159%. The correct August 9, 2020 price of $11,737 (instead of $56,612) also means that the vast majority of the +559% "Performance 1 year after [the May 11, 2020] halving" as cited here occurred subsequent to August 9, 2020, i.e. NOT in the 90 days post-halving.

James: thank you for the content you put out. Unfortunately the "Bitcoin History and the 90 Day Rule" graph cited is full of errors (the only correct numbers are the approximate “Price at halving” numbers):

1. BTC’s price 90 days before the November 28, 2012 halving (August 30, 2012) was $10.92, not $2.54.

2. BTC’s price 90 days after the November 28, 2012 halving (February 26, 2013) was $30.40, not $1007.39.

3. So the “Delta from 90 days before [the 2012] halving” was 13%, not 386.22%, and the “Delta 90 days after halving” was 146%, not 8057%.

4. BTC’s price 90 days before the July 9, 2016 halving (April 10, 2016) was $421.56, not $269.68.

5. BTC’s price 90 days after the July 9, 2016 halving (October 7, 2016) was $617.12, not $2506.17.

6. So the “Delta from 90 days before [the 2016] halving” was 54%, not 141%, and the “Delta 90 days after halving” was -5% (a 5% loss), not 285%.

7. BTC’s price 90 days before the May 11, 2020 halving (February 11, 2020) was $10,247, not $7325.

8. BTC’s price 90 days after the May 11, 2020 halving (August 9, 2020) was $11,737, not $56,612.

9. So the “Delta from 90 days before [the 2020] halving” was -14% (a 14% loss), not 386%, and the “Delta 90 days after halving” was 33%, not 542% (assuming, in both cases, that BTC’s price on May 11, 2020 was as given in the table, $8821 – it had huge price fluctuations that day, from $8200-$9200).

All this means that the vast majority of the awesome “Performance 1 year after halving" gains (over 8000% gain from November 28, 2012 to November 28, 2013; over 280% gain from July 9, 2016 to July 9, 2017; over 550% gain from May 11, 2020 to May 11, 2021) occurred AFTER the 90 days after halving, i.e. NOT in the 90 days pre- or post-halving (in fact, 1/3 of both the pre-halving and post-halving 90-day periods saw losses). In addition, the average performance of BTC over the last three halving events, from 90 days before the halving to the halving, and from the halving to 90 days after the halving, was 18% and 58%, respectively. Assuming the next halving will be on April 18, 2024, an 18% gain from the January 19, 2024 price of $41,615 (90 days before the halving) would give us a BTC price of $49,106 (which we've currently surpassed), and a 58% gain from the halving to July 17, 2024 (90 days after the halving) would us a BTC price of $77,587.

WOW on your $300K math prediction for BTC….90 days after the Halving ! Puts that price in JULY !! Awesome if it happens, but will it ? Time will tell ! Thanks for info !

Brilliant display of maths and analysis. incredibly interesting but really easy to understand.

Can see the energy and passion this chap has for his subject. you've won a fan. Thanks

What will happen if or when the ETFs are not able to buy more BTC. They are not going to keep selling positions. At some point they need to close the entries and work with only the amounts they already have. Meaning, the BTC ETFs are not unlimited, like BTC, they have a cap. Unlike gold that can always produce more, or USD that is printed on-demand.

Also, the prices you have thre are for 365 before the halving and after the halving. Nothing of this is for 90 days. So you should redo everything and make a video with correct data.

btc will run out of exchanges in July

Bitcoin transfers the counterfeiter’s limitless power to all of its participants.

Once advertising of ETFs kick in to potential investors, its another wave of demand from ETFs

i think the bitcoin history and the 90 day rule is wrong. 9:47 . the 90 days after halving price is totally wrong and absurd. 2012, BTC didnt even reach 1k, it was only in dec 2013 which is 1 year post-halving . 2020 cycle, 90 days after halving is about 33k. so do check the data properly.

Vídeo timing is quite inaccurate. Delete this video dude

Words of Wisdom.

Awesome presentation with lots of connecting dots and hope the prophecy comes true based on the historical facts…

What will happen when ALL the miners stop mining?'

Food for thought!

James could you make a new video with the correct numbers please?

Much appreciated James and IA community!